Key Takeaways:

- Snapchat’s fifth-generation Spectacles introduce advanced AR capabilities, alongside new AI features. But widespread developer and consumer enthusiasm for AR remains to be seen, something that Snap is optimistic will change over the next ten years.

- Despite increased awareness of sustainability over the past few years, consumer demand for fast fashion remains strong with Inditex and H&M reporting sales growth, accompanied by a forecasted increase in consumer spending in the upcoming holiday season – according to Deloitte.

- New US trade legislation targeting e-commerce platforms that use the “de minimis exemption” could potentially influence consumer behaviour indirectly. But changing entrenched consumption habits will require a concerted effort from all stakeholders in the fashion industry and will likely not happen easily.

Snap’s Spectacles: a bold bet on AR amid market uncertainty

At the Snap Partner Summit 2024 in California this week, Snapchat unveiled its fifth generation Spectacles with augmented reality (AR) capabilities.

The glasses include several upgrades: more immersive AR displays with micro projectors, dual Snapdragon processors, and longer battery life (currently 45 minutes.) Snap also introduced artificial intelligence (AI) features including a new Lens, creative AI captions, and more capabilities in My AI – the social media platform’s AI chatbot.

Currently, this iteration of the Spectacles aren’t available for consumer purchase. Developers can access them through the Spectacles Developer Program for $99 per month, equating to $1,188 annually. Snap hopes that this investment will result in a wealth of third-party apps and features for future consumer-facing AR glasses, potentially launching later in the decade. Yes, the decade. Amid a struggling share price, a tough advertising market, heavy social media regulations, and competition from well-funded rivals (including companies with much deeper pockets also going after mixed / augmented reality), Snap clearly sees this as a long-term moonshot – a potential way to hedge against its ability to successfully monetise in the near-term.

And then there is the general malaise around AR, from consumers and developers – so far, at least. Google launched Google Glass years ago, which flopped in the consumer market; and Meta recently announced that from January 2025, any AR effects built by third parties will no longer be available through its ecosystems.

But Google is rumoured to have AR glasses in the works for business and for consumers, and Meta is likely to launch their AR glasses at the end of this month. Apple is also reportedly developing AR glasses, as part of its long-term strategy to introduce wearable AR technology, expected around 2027. Other companies in the space include Magic Leap, HoloLens, and Niantic.

Snap, and in particular its Founder and CEO Evan Spiegel, seem particularly optimistic about a future that uses AR glasses. This could be because it’s one area where the company is not falling behind its peers, given the lack of a dominant player in the AR glasses market. Snap has around 800 million monthly active users that – although impressive – still trails behind TikTok (1 billion), Instagram (2 billion), and Facebook (3 billion). In terms of advertising revenue, Snap is also lagging, with a much smaller portion of their revenue coming from subscriptions when compared to rivals.

Snap also has an advantage in its young user base. The company claims to reach 90% of the 13- to 24-year-old population and 75% of the 13- to 34-year-old population in more than 20 countries. And this demographic may prove to be the most receptive to adopting AR devices; they have grown up with enhanced digital interaction – they are used to a world where smartphones, gaming, and social media are the norm – and are accustomed to integrating technology into daily life for both communication and entertainment. AR could just be the next, natural step – which is something the digital fashion and virtual try-on communities would definitely welcome.

Before that, though, there will need to be developer buy-in.

“Our goal is really to empower and inspire the developer and AR enthusiast communities,” Snap’s Evan Spiegel tells Alex Heath for The Verge. “This really is an invitation, and hopefully an inspiration, to create.” Spegel adds: “We’re trying to be the most developer-friendly platform in the world.”

One has to wonder, though, why developers would be eager to create software for Spectacles at this point – given the absence of a strong market and the high cost of access. It may come down to that optimism that Snap is attempting to sell. Alternatively, it might come down to developers’ personal ambitions, as this is a significant opportunity in a field that – despite years of development – still feels fresh and exciting. AR in fashion, in particular, has the potential to play a big role both upstream and downstream – from improving the way that brands and their partners work with digital assets, to virtual try-on for customers, to transforming retail spaces for immersive brand experiences that blend the digital and physical worlds.

Enough developers could well be inspired by this future of AR, especially if they get to contribute to its evolution in a meaningful way.

Fast fashion continues to thrive: can the new US trade legislation change consumer behaviour?

While sustainability efforts are gaining momentum in the consumer world, many shoppers have yet to meaningfully change their buying habits – and predictions for the 2024 holiday season suggest that another increase in consumption is on the horizon.

This week, Zara parent company Inditex released their half-year financial results, showing a 10.1% increase in net income, and 7.2% increase in sales growth (coming to €18.1 billion.) Inditex also owns Bershka, Oysho, Pull&Bear, Stradivarius, Massimo Dutti, and Zara Home in addition to its flagship Zara brand.

Inditex CEO Óscar García Maceiras said that the rise in sales wasn’t driven by price increases, but rather by the higher volume of items the Spanish retailer sold during the past six months. Maceiras attributed part of the sales growth to the company’s more refined and selective approach to physical retail, though he didn’t provide a breakdown between in-store and online sales.

This places the Spanish retailer ahead of competitors like H&M, which also reported a rise in sales in its latest results.

Meanwhile, according to Deloitte’s annual holiday retail forecast, US sales are likely to increase between 2.3% and 3.3% in the 2024 end-of-year shopping period. A key driver of overall retail sales growth in the upcoming season is expected to be e-commerce. Deloitte forecasts e-commerce will likely grow between 7% and 9%, year-over-year, during the 2024-2025 holiday season to between $289 billion and $294 billion this season.

For all the smoke around trends like “underconsumption core,” consumers are not moving away from buying more en masse. But their behaviours might still wind up changing through an indirect route.

On Friday, the Biden administration revealed new measures targeting overseas e-commerce platforms that ship huge volumes to the USA, like Temu and Shein, which the White House has accused of exploiting the “de minimis exemption.” This rule permits imports valued at $800 or less to enter the US without incurring duties or taxes. The White House reports a surge in shipments claiming the de minimis exemption, rising from approximately 140 million to over 1 billion annually. Not all of this can be attributed to fashion, obviously, but there’s little doubt that the loophole has played a part in fueling the growth of the non-domestic fast fashion industry, exacerbating poor working conditions in foreign factories and intensifying environmental harm – even if these are not the primary reasons for the policy shift.

Although international trade legislation aims to protect domestic consumers (and shore up domestic brands), it could also lead to increased shipping costs and longer processing times due to stricter border checks. This may deter some shoppers from purchasing as frequently from at least the international purveyors of ultra-fast fashion – or at all.

How far, though, is this a case of tackling a symptom instead of a cause? Companies like Shein and Temu weren’t built to exploit a loophole in de minimis regulations. Their success hinges on the overwhelming and consistent consumer demand for low-cost, fast-fashion apparel and textiles. They’ve likely been preparing for these regulatory shifts and recognise that even with a slight price increase, their offerings will remain competitively low, ensuring consumer demand. While the US government aims to create fairer competition for domestic retailers and manufacturers, the price gap between local and international e-commerce platforms remains vast, keeping them on different playing fields. And there remains, of course, the possibility that companies on Shein’s scale will lean on their suppliers to protect their margins.

Seasonally or otherwise, the overwhelming demand for fast fashion isn’t going anywhere, and it’s clear that simply changing the shipping rules won’t reverse the trend. However, this doesn’t mean that all those in the fashion industry advocating and actioning sustainable practices should back down in their efforts. Incremental changes and persistent efforts (whether they have direct sustainability labels or not) can lead to long-term improvements, and small victories can accumulate to drive broader systemic changes.

The best from The Interline:

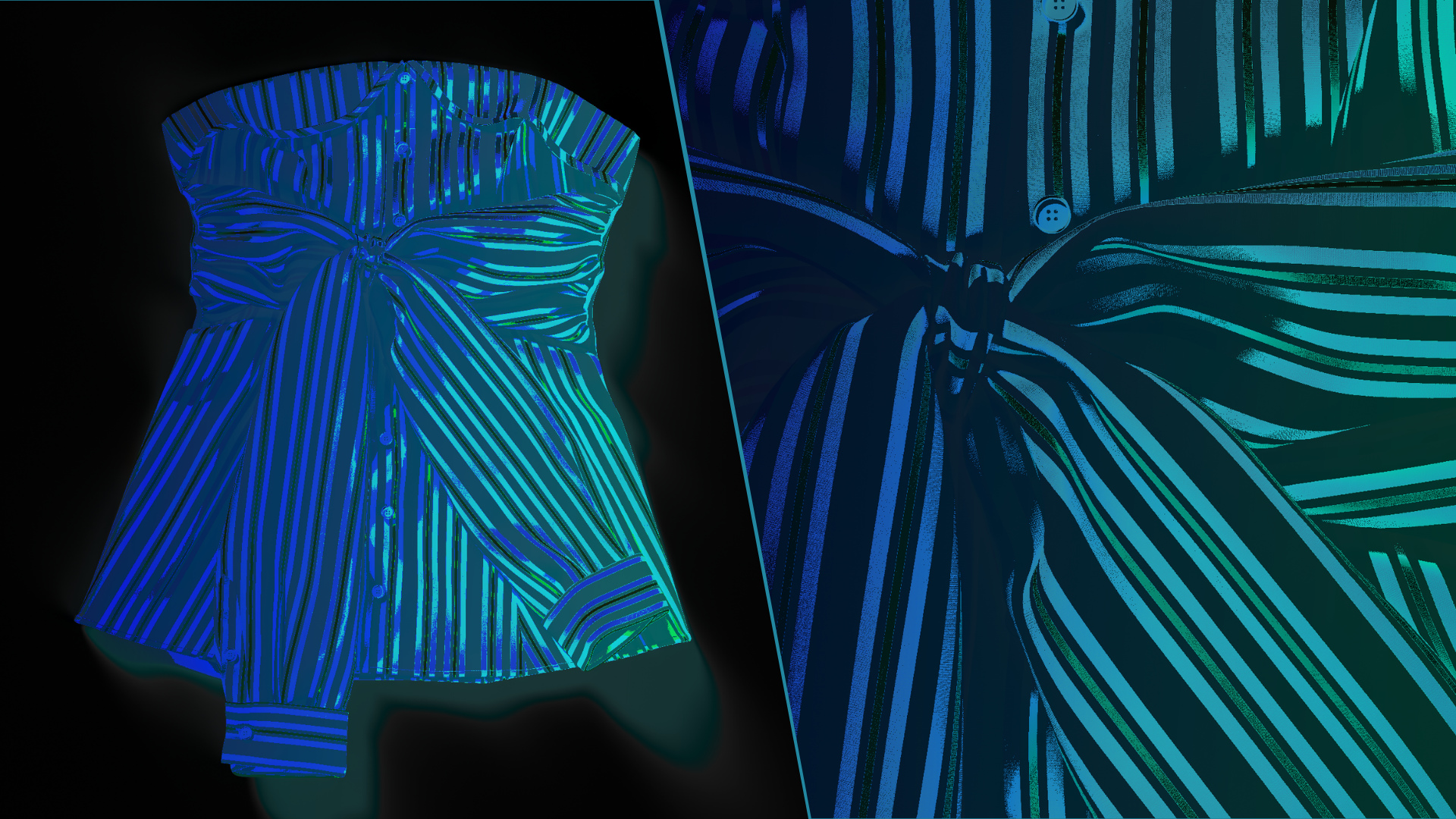

With a global perspective on the practicalities of large-scale fabric digitization and use, The Interline and Cotton Incorporated take stock of the journey of digital product development, chart the changing use cases for 3D assets, and find a more meaningful business case than ever for comprehensive digitization strategies – for cotton and beyond.

In her latest exclusive, Dakota Murphey explores the role technology could play in de-influencing, underconsumption, and the ability of brands to respond.

On the latest episode of The Interline podcast we welcome the Founder and CEO of Save Your Wardrobe about driving systemic change in the fashion industry through their solution for brands, local businesses, and consumers.