Key Takeaways:

- Gucci has leaned on Italy’s Cassa Integrazione Guadagni Straordinaria (CIGS) (Extraordinary Income Support Fund) to support its domestic craftspeople amid production difficulties, reflecting the ongoing challenges in fashion’s luxury market and the speed with which supply chain disruption can strike close to consumption markets

- Italy’s antitrust agency is investigating potential misleading environmental claims by fast-fashion retailer Shein, in line with the European Union’s Green Claims Directive that seeks to ensure companies substantiate their environmental assertions and protect consumer rights.

- Amazon’s integration of generative AI through its assistants, Rufus and Amelia, as well as Meta’s potential investment in EssilorLuxottica reveals a growing trend of strengthened connections between tech and fashion companies. Regulators have passed on recent investments by retail giants in AI giants, but governments and shoppers should brace for fresh challenges – particularly around data privacy, antitrust issues, and consumer protection.

Italy’s government and antitrust agency provides proactive support to fashion workers and consumers

This week, it has been reported that Gucci has turned to the Cassa Integrazione Guadagni Straordinaria (CIGS) – the government’s “Extraordinary Income Support Fund” – for three of its industrial entities. The CIGS allows for the replacement of wages for suspended or reduced-hours for workers of companies experiencing production difficulties. The last time Gucci introduced the measure was during the COVID-19 pandemic, when manufacturing workers were amongst the hardest-hit.

All three of the entities are located in Tuscany – known for being a high-end manufacturing and sourcing base for most international luxury brands, the base of suppliers of cotton, viscose, and wool fibres and fabrics, leather workers and artisans, centuries-old craft businesses, and heavily regionalised expertise.

Last year around this time, the area was faced with climate-related challenges in the form of flooding that also affected the luxury supply chain. This year, there are other problems afoot, namely the global slowdown on fashion’s luxury market. Gucci, and its parent company Kering have been struggling in particular, where earlier in the year saw share prices plummeting and a 18% decline in Gucci sales for Q1 2024.

Beyond just Gucci, according to the Tuscan Confederation of Craft Trades and Small- and Medium-Sized Enterprises (CNA) 2024 has so far seen 304 of these companies shut down in the region – 182 of them in the leather goods sector. This is due to a 9.1% fall in turnover and 8.5% fall in foreign exports.

The Italian government has shown strong support for its fashion industry, agreeing to give assistance with debt rescheduling assistance, tax breaks for research and development, international promotion efforts, and expanded social welfare benefits. The government has also reaffirmed its commitment to the “Made in Italy” law (which came into force on the 11th of January 2024), aimed aimed at “enhancing and promoting, in Italy and abroad, excellent productions, cultural heritage and national cultural roots, as factors to be preserved and handed down not only for identity purposes, but also for the growth of the national economy within the scope and in coherence with the rules of the internal market of the European Union.”

At the same time, Italy’s antitrust agency (the ACGM) recently launched an investigation into a Dublin-based company that operates Shein’s website and app over possible misleading environmental claims made on the fast-fashion retailer’s website.

The investigation is focused on Infinite Styles Services CO. Limited and alleges that Shein’s website attempts “to convey an image of production and commercial sustainability of its garments through generic, vague, confusing and/or misleading environmental claims.” In particular, the information provided about the ‘evoluSHEIN’ clothing collection, which is marketed as sustainable, may mislead consumers regarding the actual percentage of “green” fabrics used. Shein also failed to disclose that the garments are not recyclable. And while Shein’s website promotes its commitment to decarbonisation, this claim appears to be contradicted by the rise in greenhouse gas emissions reported in Shein’s sustainability reports for 2022 and 2023.

Under the European Union’s Green Claims Directive, which took effect this year and will be enforced across all member states in two years, companies are prohibited from making vague environmental claims about their products, such as labelling them “energy efficient” or “environmentally friendly,” without providing supporting evidence. During the development of the directive, the Commission discovered that over 50% of the green claims made by companies in the EU were vague or misleading, and 40% lacked any substantiation.

Italy’s antitrust authority, responsible for overseeing both market competition and consumer rights, has recently initiated investigations into major players like Google and luxury fashion houses Armani and Dior. These probes are part of its ongoing efforts to protect consumers and ensure fair competition.

In both of these cases, upstream visibility and deeper connections between brands and their Tier 1 (and Tier 2) suppliers has the potential to help identify risks early, and the role of technology in substantiating sustainability claims is the key subject of The Interline’s just-released Sustainability Report 2024. At a higher level, though, there is a limit to what software and services can do to mitigate the impact of a changing or slowing market.

Should we be concerned about the deepening of ties between tech and fashion companies?

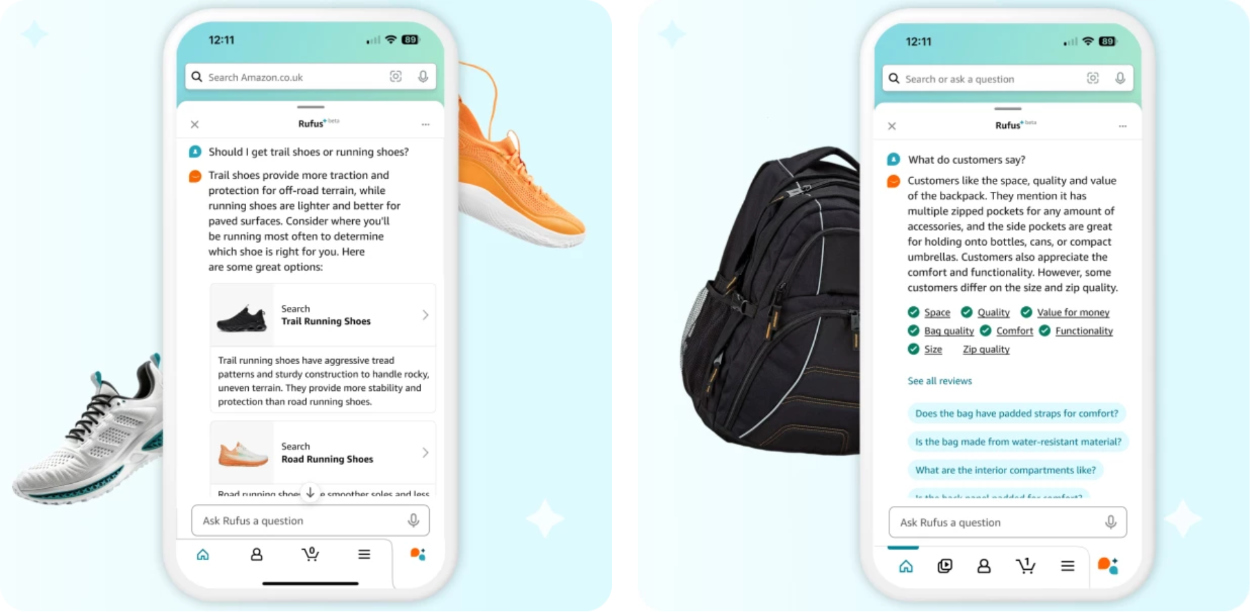

If you’ve opened the Amazon app recently in the USA or UK, you’ll have noticed Rufus, Amazon’s generative AI-powered conversational shopping assistant. While the company has been doing generative summaries of customer reviews for a while, the generative AI chatbot for shoppers is now extremely front and centre – elevated from being a background feature to having a dedicated button along the same privileged row as basic features such as the shopping cart. This might seem like a minor UI change, but the implications are large: chatting to a retailer’s AI bot is now considered a task on the same order as browsing.

According to the company, Rufus has been helping customers with understanding product details, discovering product recommendations, comparing options, getting the latest product updates, accessing their orders, and even answering questions not “obviously” related to shopping.

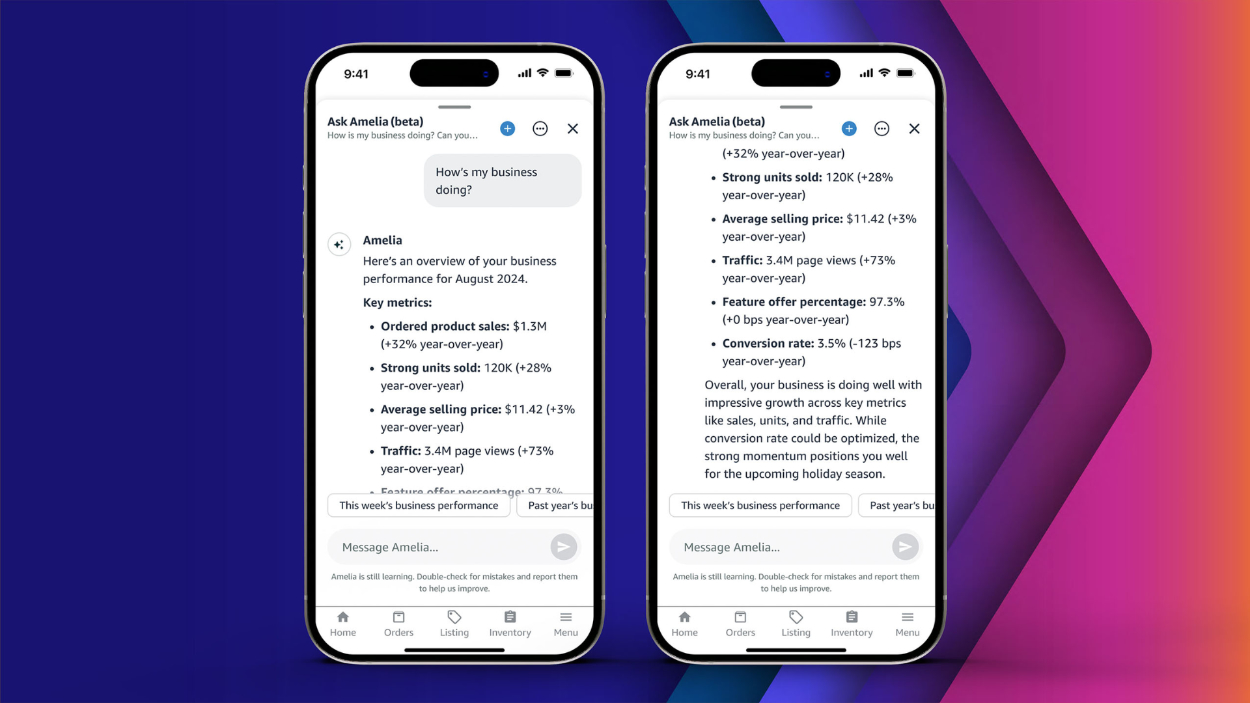

Amazon also recently announced a new generative AI-based selling assistant codenamed Project Amelia. The mission: to make it as easy as possible for sellers to manage and grow their businesses, due to the many targets they need to hit to be successful. This involves addressing specific customer needs, complying with regulations, promoting products to attract and retain customers, forecasting sales trends, managing supply chains, and maintaining optimal inventory levels.

Amazon’s roll-out of these features over the second half of September (now complete in the major markets we listed) forms part of a wider trend of deepening ties between tech companies and retail and fashion companies. Since July, rumours have been flying that Meta plans to spend billions to buy roughly 5% of eyeglasses behemoth EssilorLuxottica. This seems highly likely given the September announcement of Meta and EssilorLuxottica’s extended partnership for developing smart eyewear.

And the latest from Meta CEO Mark Zuckerberg – hot off debuting the first working prototype of augmented-reality glasses during Meta’s annual Connect conference – is that a prospective investment by Meta Platforms to EssilorLuxottica will be a “symbolic” gesture to cement their long-term partnership. “I think we’ve talked about investing in them. It’s not going to be a major thing. I’d say it’s more of a symbolic thing. We want to have this be a long-term partnership…I fundamentally believe in them a lot. I think that they’re going to go from being the premier glasses company in the world to one of the major technology companies in the world,” Zuckerberg said in a video interview published this week on The Verge.

For fashion’s purposes, the undercurrent of this investment is fascinating. While it’s unlikely that EssilorLuxottica will become ‘the Samsung of eyewear’ as Zuckerberg predicts, there is still the understanding that tech companies wish to invest in fashion companies where they see a route to influencing the next era of wearable technology platforms. And for the fashion businesses they invest in, the money comes with the caveat that future success could be measured by how well they integrate technology with their design and production expertise.

So in the future, we might be seeing more and more fashion companies look like tech companies – especially given the tough moment that retail and luxury is in. There could be a lot of benefits for brands and retailers: more innovation, more efficiency and heightened engagement for consumers and professionals, the generation of more data for better business insights, and an extended global reach. On the other hand, partnering with tech firms (who hold a lot of the financial power) may lead to a dilution of the brand’s identity if the technology overshadows the brand’s core values or aesthetics. Over-reliance on tech solutions also has the potential to make fashion companies vulnerable to tech failures, data breaches, or cybersecurity threats. And to the data point, increased data collection and analytics may raise privacy issues among consumers, if not handled transparently.

This is another frontier that regulators may have to tackle soon, if big tech companies are allowed to corner the distribution in completely new areas. The main points to be addressed will likely be around data practices and privacy, antitrust and market access, and consumer protection around advertising and marketing – just to name a few. Regulators may also need to adapt existing frameworks to address the unique challenges posed by the convergence of technology and fashion, ensuring that laws keep pace with innovations and swiftly-advancing business models.

The Interline’s Sustainability Report 2024 – available now

Earlier this week, we published our second deep-dive report on the evolution of technology for sustainability – covering the changing landscape of legislation, the mechanics of traceability, the outlook for skilled workers in a circular value chain, and much more.

Available to download, free and un-gated, The Interline’s second Sustainability Report features exclusive editorial from a range of industry perspectives, detailed technology vendor profiles and executive interviews, and an updated analysis of the market for sustainability solutions in fashion. This year’s Sustainability Report is supported by Munich Fabric Start, and contains an exclusive foreword and insights from Managing Director, Sebastian Klinder.

Building on the initial thoughts and findings set out in our Sustainability Report 2023, this 2024 edition examines how the definition of sustainability is shifting, and how technology solutions are evolving to meet it. It contains unique stories, told by industry figures, and key insights into how some leading technology companies are building the infrastructure and the experiences that fashion urgently needs.