Key Takeaways:

- US retailers are moving into a holiday season that remains unsettled. Forecasts converge around modest growth (National Retail Federation prediction 3.7% to 4.2% growth, surpassing $1 trillion in total sales), yet some analysts still point to a softer close, as Inflation, tariffs and rising unemployment continue to impact household confidence and spending power.

- New AI shopping features arrive at a timely moment. Google’s new AI shopping updates include price agents, comparison prompts, refreshed virtual try-on and early tests of automated store-calling, all of which help to reduce friction and steady the path to purchase. ChatGPT’s “Buy” button and new Shopping Research Mode move in the same direction, offering clearer guidance during the decision making phase.

- These tools help the journey along, but their influence sits behind the wider mood rather than above it. They make it easier for people who already intend to buy, although they cannot expand demand in a year when households are watching their budgets closely. The coming Black Friday and Cyber Monday window will provide the first real sense of whether confidence is rising or holding back.

As we enter the tail end of the year, it feels fair to say that retailers in the United States are heading into the holiday period with fewer certainties than usual. Some reports point toward a season that might support modest growth. Others make a reasonable case for a softer close. What we can see right now, a few days out from Black Friday, is a landscape that refuses to settle. Markets have been unsteady for more than a week. The latest reading from the University of Michigan shows sentiment drifting down again, sitting close to record lows.

Analysts are preparing for a season where spending could rise, stall or drift sideways, and none of those outcomes would surprise anyone. The major forecasts don’t contradict one another so much as circle the same conclusion: the result will likely sit somewhere between mild growth and a gentle step backwards.

There is a sense that we will simply have to wait and watch, but we do have some markers when it comes to objective scale and scope, even if the specifics are still murky at the moment. The National Retail Federation expects holiday sales to pass one trillion dollars for the first time. Their forecast range lands between 3.7 percent and 4.2 percent growth. Taken out of context, that sounds impressive. Inside context, it reflects slower expansion than last year.

At the same time, the pressures shaping household behaviours remain readily visible. Inflation, stubborn as it has been for more than a year, continues to influence how people prioritise purchases. Tariffs are still pushing at price levels, and the current US administration still shows little consistency in how it applies them. Unemployment is nudging higher too. None of these forces guarantee a downturn. What they do is make shoppers more deliberate. Even when people feel uncertain, they still shop. They just think more carefully about where the money goes.

Fashion sits right in the middle of this during the holiday season. Clothing remains a dependable gifting category, and people still want new things for the season. It is also one of the first places where behaviour shifts when pressure builds. We covered this recently in our newsletter on the rise of ultra-fast fashion, which continues to thrive precisely because shoppers feel squeezed. Surveys show plenty of enthusiasm for seasonal shopping, although they also show more interest in value, practicality and staying inside budget. Retailers face a familiar task. They need to take friction out of the journey and give shoppers clearer reasons to complete it.

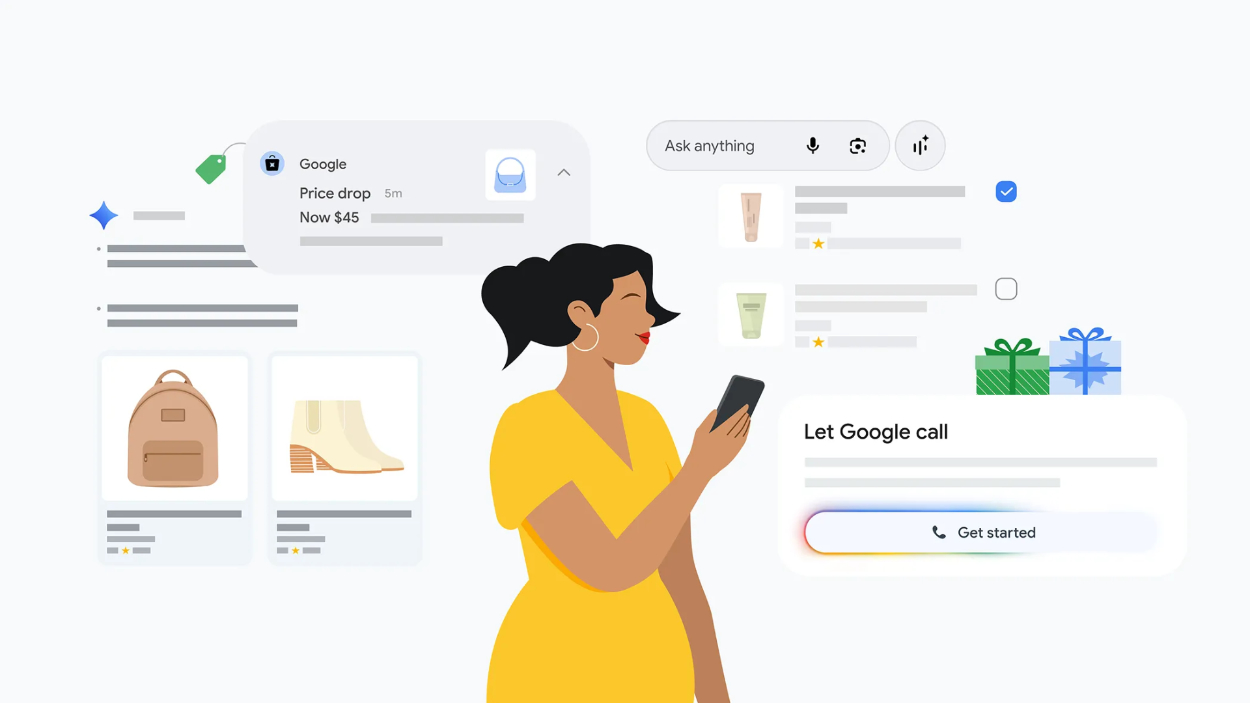

That’s why the release of Google’s newest shopping tools feels well timed, and is probably the most accurate barometer for the impact that AI could have on the shopping journey, simply because of the many, many eCommerce-adjacent surfaces that Google operates. The rollout began just ahead of Black Friday, and the platform is made up of price agents that watch items on your behalf, conversational prompts designed to make comparison easier, virtual try-on has received another round of attention, and Google has even introduced an automated store-call service that can ring physical shops to check stock and pricing.

Google’s own research describes modern shopping as a maze of discovery, searching, evaluating and cross-referencing across multiple platforms. Anything that clears even a small part of that path improves conversion and cuts down on the abandoned decisions that stack up during busy periods.

The idea behind these tools is straightforward. The more you understand what you are buying, and the easier it is to confirm availability and value, the more likely you are to finish the journey. None of this is about pushing people to spend more, necessarily, but rather to give users more control over their shopping journey – even if, eventually, Google’s relationships with major brand partners will see success judged according to growth.

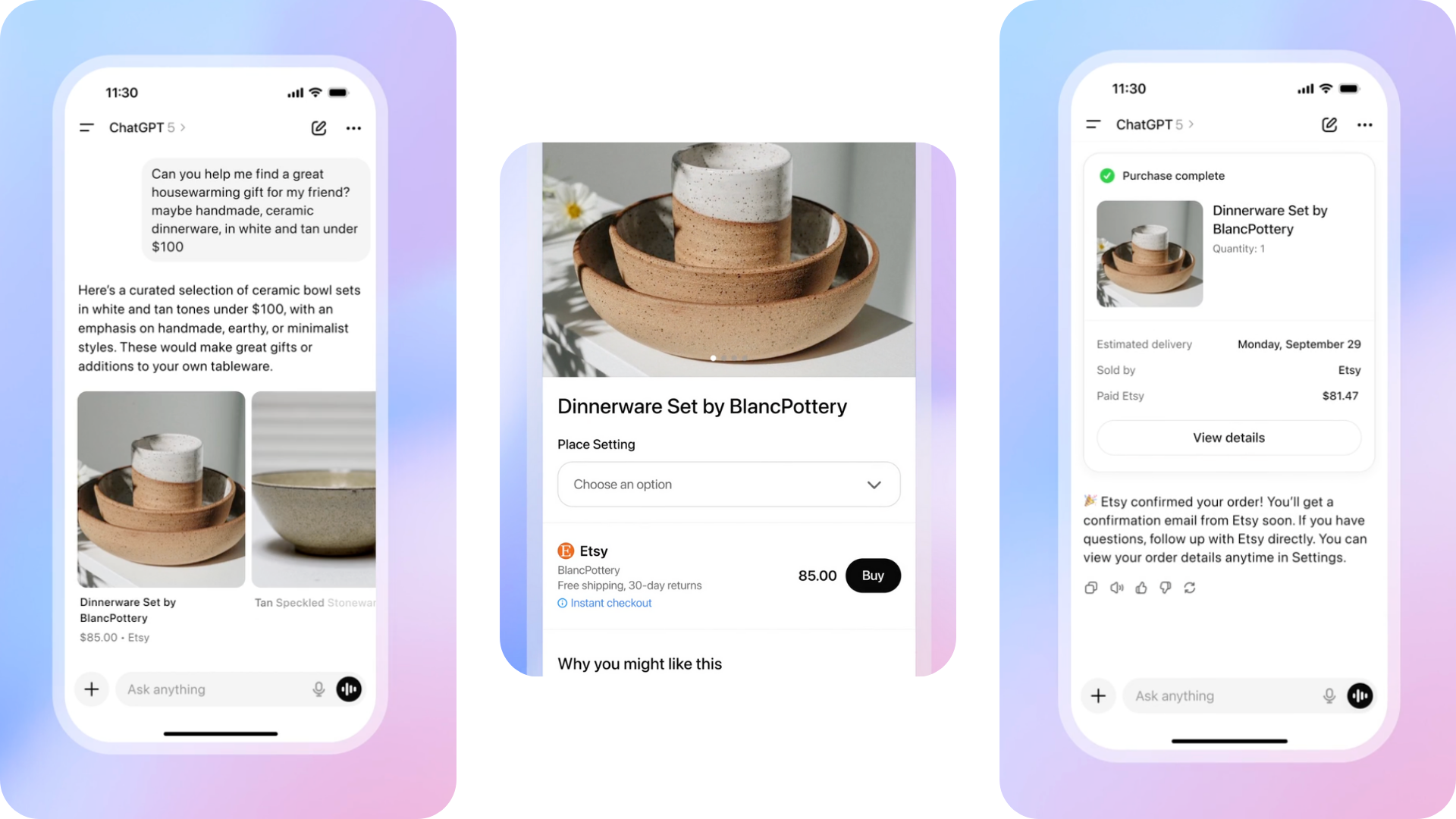

At the same time, ChatGPT has been edging into the shopping journey as well, and those developments culminated in the release of a new, dedicated “shopping research” tool that receives the same top-billing as image creation and model picking in the company’s apps. The age of the AI “buyer’s guide” has come around fast.

Whether this becomes a primary way of finding and buying products, though, remains an open question. It does, however, solve a real problem. Much of fashion purchasing starts with vague and ill-specified intent, rather than a clear statement. Someone needs a warm jacket for seasonal weather that’s location-dependent, or something suitable for a work party. They are often not thinking in terms of a specific brand or silhouette, and subjectivity plays just as much of a part as objective research. Conversational discovery works well in that early phase. It can follow the shopper’s drift. It can filter by taste, and point out the small details that help someone settle on a choice. It behaves more like an attentive store associate than a traditional search bar.

(Look for an upcoming episode of The Interline Podcast that targets exactly this topic!)

The question hanging over this season, then, is a simple one. Do these improvements impact the overall pattern of holiday spending, or do they just make the journey cleaner for people who were already planning to buy something? Is better shopping, thanks to technology, enough of a boon for people to buy at a time when their wallets feel light?

A smoother journey always helps. Guided discovery does too. And history has shown us that retailers who excel at removing friction tend to rise above those who make the shopper do the heavy lifting. Yet none of this guarantees a stronger season because the limiting factor is still the shopper’s budget. No matter the sophistication of the tools they simply can’t manufacture demand in a year when households are watching their spending with more care.

What feels more certain is that these ideas will keep moving forward. AI assistance will continue to expand across the shopping experience with conversational discovery becoming even more normalised than it is right now. Fashion and beauty is likely to feel this before other categories because those sectors rely so heavily on imagery, detail and the ability to compare subtleties. It’s not by coincidence that some of the first “instant checkout” sightings inside ChatGPT come from fashion and beauty brands. They are the categories that benefit most from guidance that feels more tailored and less mechanical.

But all of that likely sits just beyond the immediate horizon. Right now, retailers are working inside a season that could lean either way. These tools will help the retail journey along, but they sit beside the wider mood rather than above it. That’s why the next few days will be important. Black Friday and Cyber Monday tend to offer the first real readout of intent, and this year more than most, everyone is watching for whatever signal comes through.

The holiday outcome will settle where it settles. AI might play its part by making the path a little easier, but the bigger story sits with the shopper and how they behave in the coming week. Once the numbers land, we will have something firmer to work with. Until then, it remains a waiting game.