Key Takeaways:

- The recent struggles of multi-brand retailers like Matches Fashion and Farfetch highlight a need for these channels to establish and maintain themselves through robust technology infrastructure and innovation in experience – as well as through their assortments.

- As part of the wider devolution of power in trend creation and dissemination, consumers are no longer reliant on large multi-platform e-tailers for curation and discovery, elevating the user experience – underpinned by technology and innovation – to the top priority.

Today, the 15th of March, is traditionally an unlucky one. It’s the day Julius Cesar was assassinated, which William Shakespeare dramatised with its famous line: “beware the ides of March.” Although not exactly true to the day, this is a warning that Matches Fashion might have heeded.

The online retailer, purchased by British retail company Frasers Group late last year, announced this week that it was entering administration. Purchased for a bargain price of £52m in December 2023 (given its previous valuation was closer to £1 billion, in 2017, when it was acquired by a private equity firm) Frasers did not appear to buying the company simply to strip it for parts, but in very short order the retail giant determined that Matches required “too much change” to move beyond its current loss-making, target-missing status. And while Matches’ online storefront is still operational (presumably in the hope of divesting inventory), the business is effectively being mothballed.

This is quite a serious fall from grace. Matches was founded in 1987 by husband and wife Tom and Ruth Chapman as a brick-and-mortar store in London, where it built a reputation for its ability to build relationships with top brands and designers, and its tight curation of assortments. Matches eventually expanded into an e-commerce giant: at one point, Matchesfashion.com, the company’s online channel, was selling over 600 luxury labels and distributing to more than 170 countries.

So what happened between then and now?

At least part of the picture can be explained away through the common problem of overreach. While Matches did maintain a few physical locations in London, and sold domestically through its online channel, most of its customers were international – the typical mix of high net worth individuals in global markets that helped to fuel the COVID-era luxury boom.

In a tale as old as time, expansion translated into risk exposure. Like many luxury fashion retailers – including its main competitor Farfetch – the international demand that had fuelled Matches expansion started to evaporate over the last year as even luxury shoppers pulled back on discretionary spending, driven by the prevailing macroeconomic conditions of high inflation and interest rates.

(Farfetch, not coincidentally, was also recently sold for an absolute steal, relative to its previous valuation.)

These same forces, of course, also apply to luxury groups and the houses under them. Current estimates from Business Of Fashion are that LVMH-owned brands alone are sitting on more than €3bn in unsold stock combined, and it doesn’t take an economist to point out that supply here is simply exceeding demand.

The difference, though, is that stock is only part of the brand proposition. If there’s one area that luxury brands can’t be said to have dropped the ball it’s on digital marketing and innovation; most of the major maisons have made big strides into the future in terms of advertising, innovation, and experience. Unsold inventory is still a problem for these companies, but actual product is not the only asset they sell.

The same can’t be said for multi-brand retailers. While both Matches and Farfetch (and the equally embattled YNAP) have attempted to define themselves as lifestyle labels in their own right, the reality is that pure-play retail business models are shaped by their ability to forge relationships with the right brands, build compelling assortments, and price intelligently. And when demand dries up, and inventory piles up, there’s little else for these companies to trade on.

But what about curation? If assortment-building, editing, and storytelling were the engines behind these businesses’ precipitous rises, why are they not offering a lifeline for them today? Nowadays, social media plays a pivotal role in content discovery, altering the dynamic from consumers seeking out content to content finding consumers. This shift has reduced the reliance on large multi-platform e-tailers for staying current and discovering new products. With social media feeds flooded with product recommendations from various sources, and influencers assuming the mantle of both magazine editors and store curators and merchandisers, multi-brand retailers are facing a hostile climate when it comes to

And then we have the pivotal role of technology and innovation. While Matches was known to spend quite extensively on software, the company ended up with relatively little to show for it on the frontend, despite documenting years of backend development and investing heavily in optimising its selection and pricing strategy. And although Farfetch went one further, offering its own ‘platform solutions’, ultimately neither retailer has managed to turn shopper-facing innovation into a compelling enough reason to shop with them.

And again, this is an area where multi-brand retailers have ceded the edge to centralised platforms. Which don’t just play host to content, curation, and shopping services, but which have been able to introduce their own consumer-facing experience innovations.

Case in point is Pinterest – the image sharing and social media service that at least one member of The Interline team definitely didn’t realise was also a shopping platform – which this week announced its search filtering tool for different body types in the U.S., following initial experimentation and testing in Canada last year. The platform now showcases size-inclusive brands prominently on its search landing page. Users can access this feature by typing a query into the search bar and selecting the “Body Types” option, which displays four different body types at the top of the results page. Currently focused on women’s fashion and wedding ideas, the tool aims to enhance user engagement, with those utilising it showing a 66% higher engagement rate per session. Powered by Pinterest’s proprietary computer vision technology, which analyses shape, size, and form across billions of images on the platform, the tool contributes to a more inclusive experience. Additionally, Pinterest offers other inclusive features such as skin tone ranges and hair patterns to ensure broader representation across its user base.

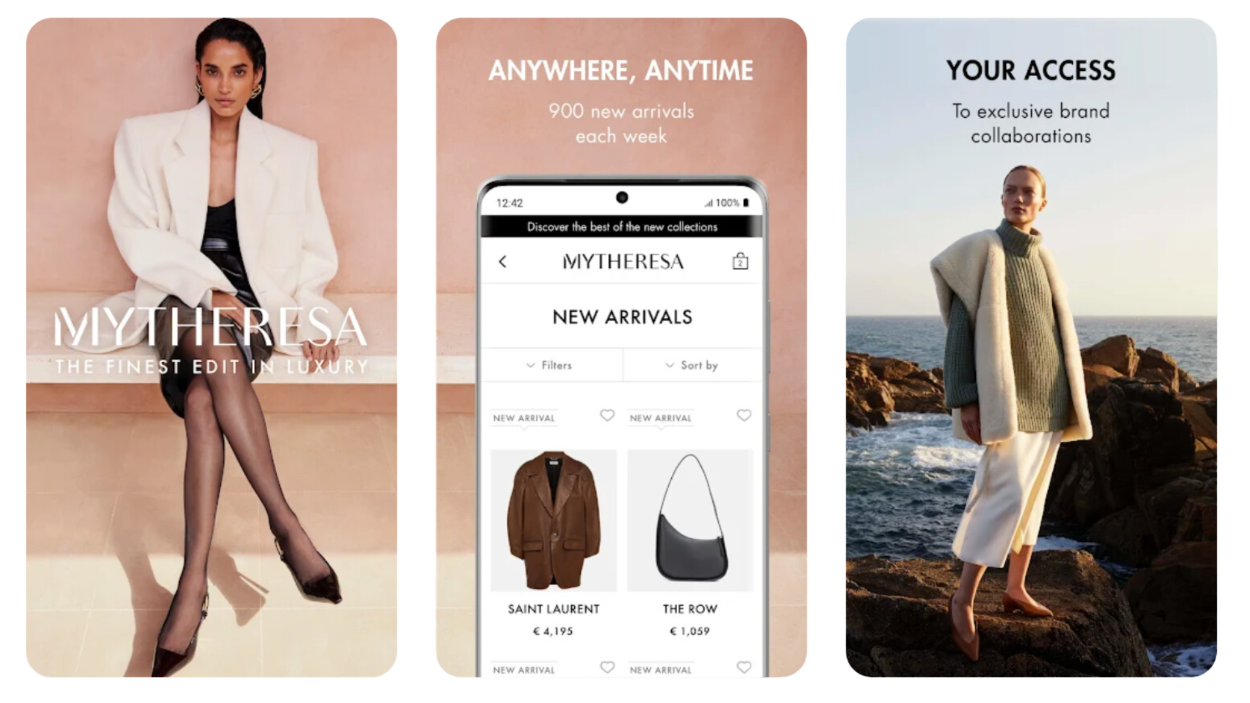

As far as multi-brand retailer innovators are concerned, two stand out in particular: MyTheresa and Zalando. MyTheresa reported double digit growth at the end of 2023 thanks to strong US sales earlier in the year, as well as by prioritising its high-end clientele and collaborating with brand partners for exclusive capsule collections and experiences to customers. Over the years, the company has continuously handpicked the best of the best from luxury brands, ensuring quality and exclusivity, and has maintained a visually appealing and user-friendly website with a mobile app. The retailer is also known for its stellar customer service spanning its global customer base.

Then there is Zalando, who is taking things to a new level to differentiate itself. In a statement released this week, the company announced that it is evolving its strategy to build the “leading pan-European fashion and lifestyle e-commerce ecosystem” in both the B2B and B2C vectors.

On the consumer-facing side, Zalando is aiming to “enhanc[e] its role in customers’ lifestyle journeys by elevating existing categories such as Sports and Kids and Family, and offering personalised inspiration and entertainment.” For businesses, Zalando is opening up its logistics infrastructure, software and service capabilities to be a key enabler for e-commerce transactions of brands and retailers, regardless whether they take place on or off the Zalando platform. This will also help fashion companies to sell on different channels from only one inventory pool, avoiding overstocking and discounts.

That’s a bit of a word salad, but the gist is this: Zalando is, for all intents and purposes, transforming from a retail-only company into a technology, entertainment, and platform business.

Breaking down the company’s detailed statement a little further, the main pillars for gaining new and retaining existing customers will be to focus on the quality of the customer’s journey, through assortment, the digital experience, sustainable and inclusive choices, as well as personalised convenience. They will also offer size advice, which uses computer vision and AI (currently about 60% of all items sold on Zalando already feature proprietary size advice). Zalando will also expand further as a lifestyle destination, following people’s lifestyle choices and building out more areas that address their lifestyle needs.

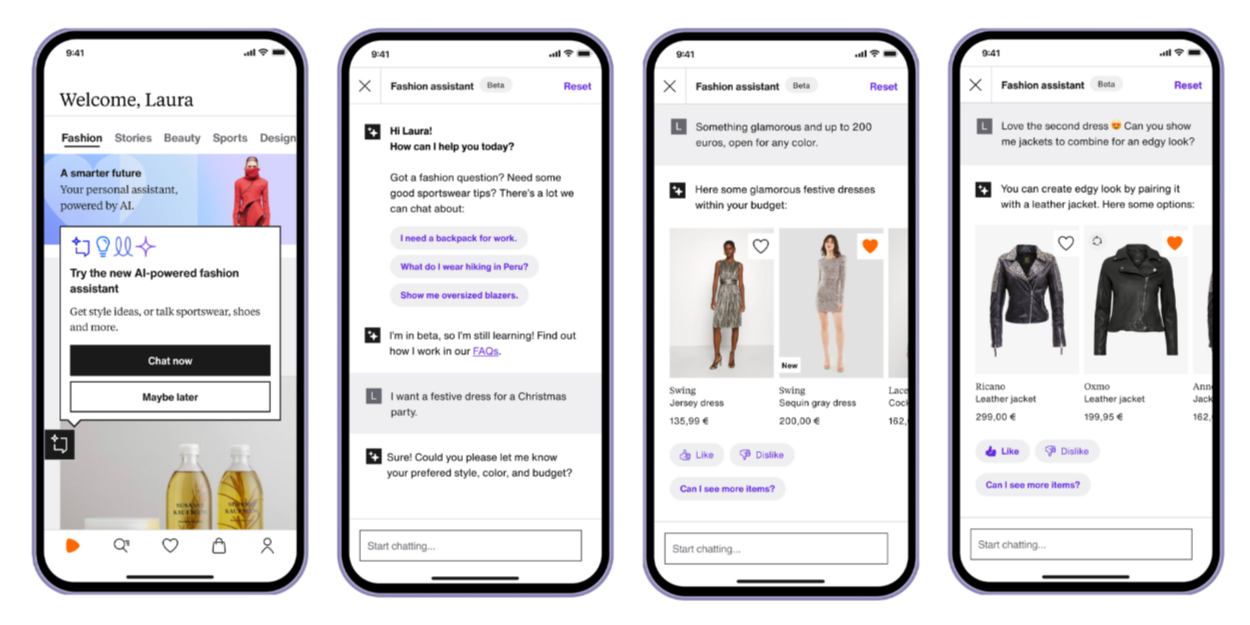

The third B2C pillar is based on integrating content into commerce and offering personalised inspiration and entertainment. Zalando intends to use data and technology to create entertaining content that will drive engagement. The company is also powering more personalised conversations with their Zalando Assistant – where customers will be able to receive tailored offerings to avoid being overwhelmed by choice and being overloaded with information.

On the business front, Zalando claims that they are uniquely positioned to help brands and other fashion retailers “overcome the inherent complexities of cross-border e-commerce in Europe, where they are faced with numerous languages, currencies, payment methods, delivery and returns options, as well as the need to manage multiple sales channels.” Or, in other words, turning size and experience into a saleable commodity.

This is something that every multi-brand business in 2024 will need to consider, as well as the fact that much of the competition will be between the technology companies behind the retailer. Technology will need to be a core part of the strategy on how the business is built out. Zalando understands this, calling itself “Europe’s most fashionable tech company.” This mindset underscores the imperative for both established companies and emerging retailers to adapt. Mere product stocking is no longer sufficient in today’s competitive market.

The best from The Interline

Antonio Talarico kicks off this week by asking what the next evolutionary step for fashion – and society – looks like?

The CEO of Strategies, Jean-Pierre Pedeboy, discusses the most effective ways for fashion businesses to stay ahead of the curve and achieve sustainable growth, and the barriers currently preventing DPC’s full potential.

Our resident News and Features Editor, Emma Feldner-Busztin, explores how DPC is slowly, but surely, becoming standard practice – and what that means for the supply chain.

Closing out the week, Mark Harrop explores how AI is unveiling fashion’s web3 era of hyper-personalisation.