[Featured image provided by Lalaland.ai]

This article was originally published in The Interline’s DPC Report 2023. To read other opinion pieces, exclusive editorials, and detailed profiles and interviews with key vendors, download the full DPC Report 2023 completely free of charge and ungated.

Key Takeaways:

- Fashion has made significant inroads – and big investments – into 3D and digital product creation. But in a difficult economic climate those long-term strategies are under increasing pressure to deliver near-term value.

- Key to delivering and quantifying that return on investment will be an understanding of the scope and the shape of the value that digital assets can deliver in different use cases – up and downstream.

- Enterprise-wide, trust in digital tools and digital objects will be built through exposure, for both in-house teams and a new generation of digital-first consumers and tech disruptors.

Increasingly sustainable supply chains, reduced sampling costs, accelerated speed to market, optimised sales funnels – the list of digital product creation’s benefits goes on. There aren’t many technology segments that can promise – let alone provably deliver – in all those different areas. And against a backdrop of slowing sales and competitive global markets, these are compelling propositions that an evolving ecosystem of tools promises to provide brands, designers, and creators across a wide spectrum of different job roles.

Take a quick scan of the current DPC ecosystem – these tools are becoming more advanced and nuanced. From upstream to downstream, there is an option for every stage of the product development process. And as The Interline found in its first baseline analysis of the size and scope of the DPC market, this is a significant technology segment in its own right – the equal of long-established enterprise markets.

However, with such a growing and saturated number of solutions available, deciding which ones to adopt is a challenge within itself – especially when a brand’s purpose for interacting with these tools is still being determined. Because while there’s been a huge and rapid rush towards 3D and DPC strategies, many organisations are now finding themselves in a post-honeymoon period, with a need to better understand and quantify the driving purpose (and the desired results) of their sudden moves into digital product creation.

When the world shifted online in 2020, and digital workflows quickly transitioned from nice-to-have to must-have processes, brands hastily built and implemented rudimental DPC strategies as a blanket solution that could allow them to operate a business-as-usual approach to product development – and who could blame them? At that moment, 3D offered a way out, and a lifeline. So, at that time, laggard adoption of emerging technology was the most precarious situation a brand could find itself in. Being behind the maturity curve, in terms of 3D and DPC, meant missing the capabilities to continue to do business.

Today, the most precarious situation is arguably a different one. Now it’s the avoidance of viewing technology realistically, strategically, and empathetically that can quickly upend a brand’s market positioning. Or, in other words, rescue has given way to realism, and crisis to cost analysis.

Over the past three years, the fashion industry’s understanding of “fashion technology” has evolved significantly. While there’s a deeper appreciation for the value of digital tools across the board, brands, retailers, and suppliers have rightly become more critical of the value that those tools can provide in the immediate term

right: Future bag created by Studio LME, SWOP

Take the downstream possibilities of DPC as an example. While there are select brands (several of which are featured in this report) who have pioneered incredibly photorealistic, consumer-facing renders of their digital garments, how many other businesses are speaking to their markets through these assets in ways that genuinely resonate?

And in the opposite direction, how many brands are really making use of their digital assets for the full spectrum of in-house and upstream decision-making to ensure that they’re creating the products and experiences their target demographics want?

Now, with the initial sprint towards 3D and DPC over, it’s time for brands to ask the following two questions: How can our digital assets serve our market effectively? And what are the tools that are really going to get us there?

Enriching Digital Products

When fashion finds itself in a volatile environment, returning to customer-centricity is often the first recommendation from any consultant, strategist or advisor tasked with assessing the current market and posing actionable solutions. After all, the business of a brand is to make and sell things people want – and to make enough margin to keep doing it.

So, when it comes to DPC, teams should deploy both 3D / DPC tools and the assets they create in a way that works vertically across the business, and that enhances different environments for diverse purposes through sales, marketing, production, and merchandising. The return on investment in those tools and those assets will then be realised in a more multifaceted way.

Michael Musandu, the CEO and Founder of Lalaland (which works to place 3D garment designs on photoreal AI-generated models) describes this process as “enriching 3D assets” – a useful term that captures the key function of a whole group of new solutions and workflows dedicated to connecting the DPC process more seamlessly with target markets.

Lalaland, for example, generates its realistic and physically diverse avatars using AI to help product development teams enhance and display assets more favourably, achieving both internal buy-in and external purchases before sampling, production, and sales are even considered. A prime example of how an investment in creating digital representations of products can be returned outside the core disciplines of design and development.

According to Musandu, Lalaland’s offer starts at the beginning of the value chain, and the benefits can be woven throughout. As the production process moves away from being linear, tools that mobilise assets back and forth between customers, buyers, and internal teams will become increasingly effective at keeping costs down, informing design decisions and providing insights for production, merchandise, and marketing strategies.

And there are many other examples of tools within this wider ecosystem that draw from different technologies to foster these same connections.

Consider more nascent technology like AR and VR – in Snapchat and Ipsos’s Augmentality Shift report of 2022, 6/10 consumers recognised shopping as their main reason for using AR, while 91% of brands think it’s primarily used for fun, highlighting the juxtaposing views of consumer intentions and brand assumptions. Start-ups such as OuttaWRLD have identified this gap as an opportunity they can bridge by helping brands create AR experiences that are product and market-specific, and that can employ the digital assets that brands have already built for their own in-house purposes – with the right tools for asset management, preparation, rendering and so on.

Also using virtual try-on, Modern Mirror’s Avante-Garde Fitting System allows designers to implement alterations, customisations, and personalisations specific to individual customers using 3D designs. That company was featured in The Interline’s first DPC Report in 2022.

Then there’s PlatformE, whose B2B Custom service enables personalisation at the point of sale through digital assets, and who The Interline have collaborated with several times this year.

These examples breathe additional life into digital products, create engaging experiences, and allow customers to see their physical selves reflected in these rendered garments, bringing value to consumers. And they all have their roots in the same corner of 3D and DPC that brands rushed to occupy when their entire business models seemed to be under threat.

From Digital Fashion to Digital Product Creation

Achieving internal buy-in from decision-makers to invest in market-activating solutions may, at first, take time. The burst of the metaverse bubble and the resulting volatility in the digital fashion space have caused trepidation around the ROI when using consumer-facing applications for digital products. For better and worse, those two trends have become conflated, and as The Interline wrote this summer, the fallout from the tempered expectations around digital fashion then spread to digital product creation as a whole.

Street 02 created by Mast Studio, SWOP

However, an argument can be made for digital fashion’s ability to, first and foremost, immerse consumers in brand and product stories, and to democratise access to fashion – both of which, again, are possibilities that begin life in the same space and the same solutions where digital design and development happens.

And although primarily untethered to the physical world, some essential lessons are emerging in the sphere of digital fashion. Recent research presented in Roblox’s 2023 Digital Expression, Fashion & Beauty Trends report uncovered the influence of digital fashion on their IRL consumption habits. The study found that 43% of Gen Z respondents want to see brands increasingly provide options to twin the items they wear on their physical and digital selves.

“We see this as a natural progression.” Lisa Bagge, the Co-Founder of SWOP explains when I ask about DPC. As a digital-first AI platform allowing users to generate new designs via editorial-quality imagery, SWOP sees the eventual value that physical production can bring to their business model, working backwards to transform community-created and emotionally resonant digital fashion into products to be marketed and sold – a process that’s highly likely to involve 3D design and simulation as the stepping stone.

Putting Faith in Digital Twins

There are, however, challenges to this approach. “Uncanny Valley” – another phrase Masandu uses – describes a key hurdle to customer acceptance of digital assets, and their willingness to place trust in digital virtual models. When the end goal is to convince customers to buy a physical product, a lack of realism (or a looming sense that the digital and the physical are not close enough to one another) can be a significant problem in acquiring trust towards these digital representations.

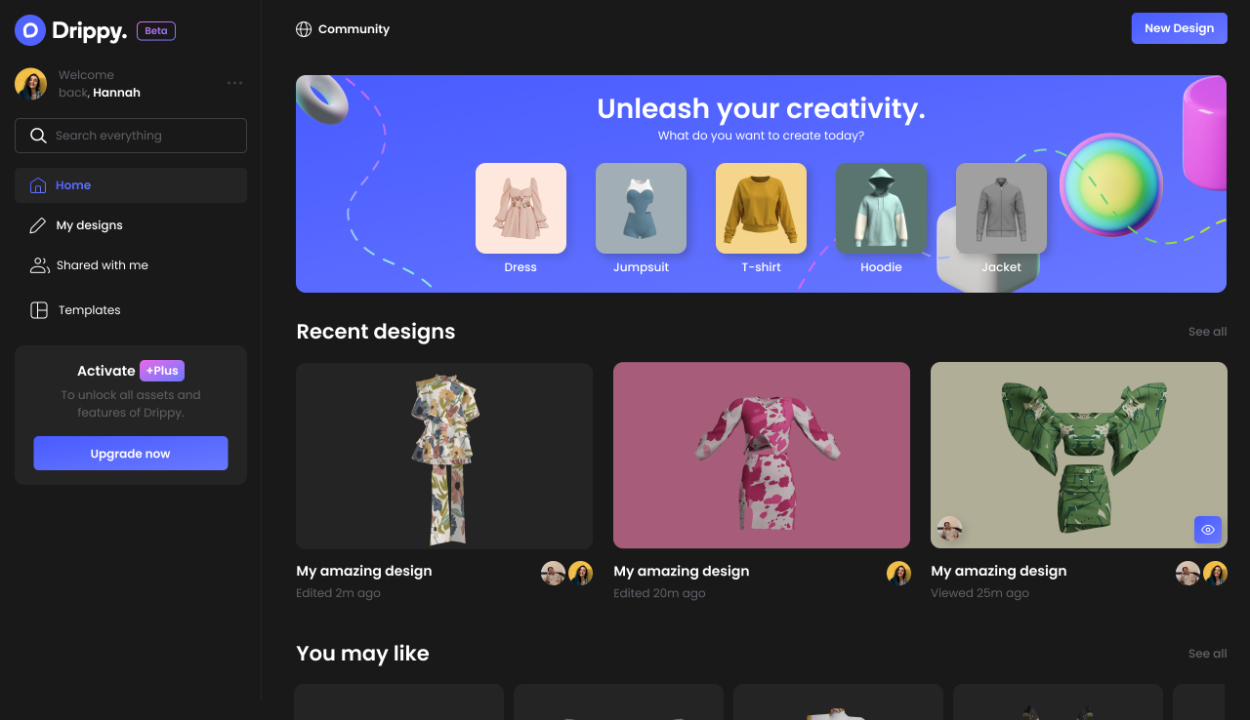

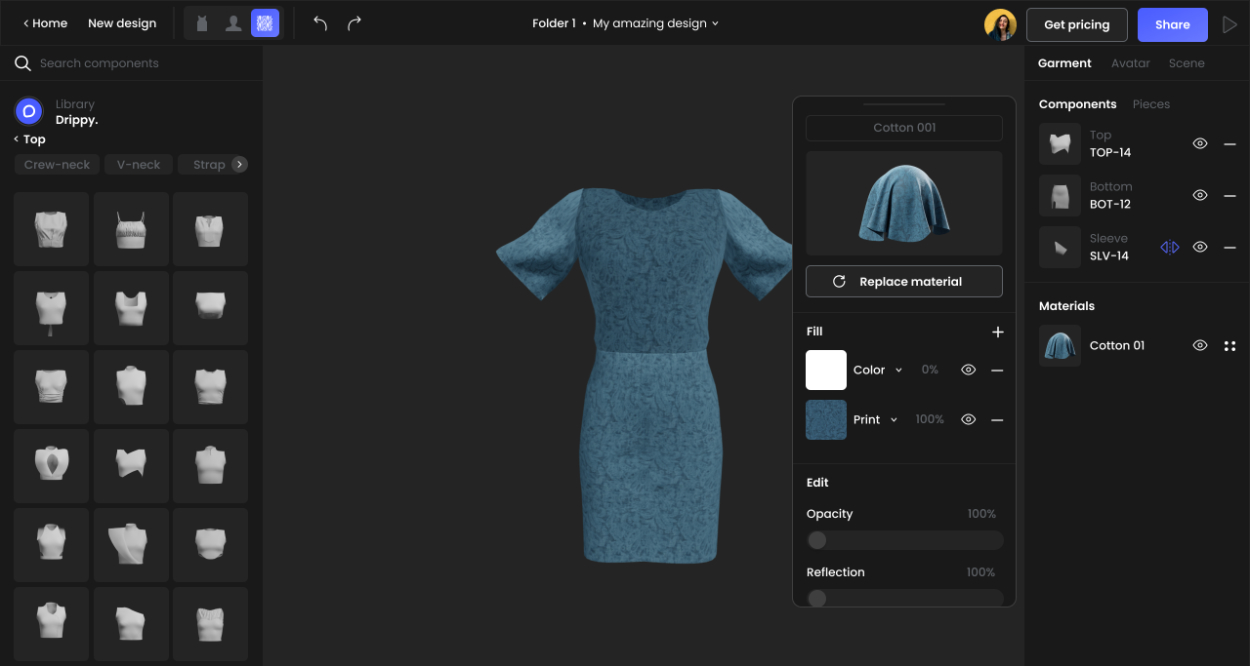

“[Sometimes] designers forget the feasibility of the 3D design and create 3D renderings that do not accurately represent the real-life characteristics of the garments.” acknowledges Tan Nguyen, the CEO and Founder of Drippy.

This disconnect is a problem that was noted early on when, DPC started to be heavily implemented across the industry, and a lot of work has subsequently been done on the refinement of digital twins to improve their fabrication, rendering, and movement.

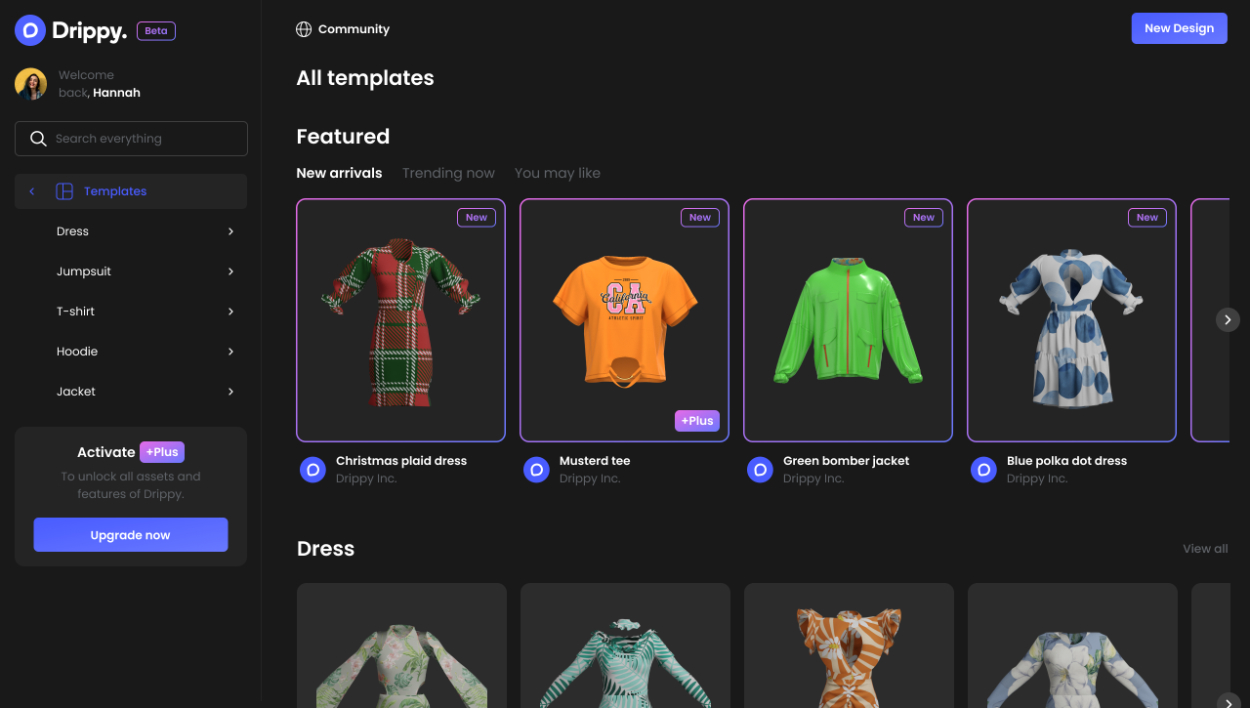

But as brands seek to work more flexibly and collaboratively, product creation teams must have the confidence to generate and communicate ideas with customers freely whilst embedding the practicalities of garment construction into their designs – this is a gulf that cannot be allowed to widen. This is what could make Drippy an exciting proposition. As a platform that aims to make DPC equitable by allowing anyone to easily adopt 3D design regardless of their experience through “customisable templates and free materials, ” this “LEGO for fashion design” solution aims to enable users to rapidly communicate design ideas at any skill level – shortening the distance between vision and visualisation.

Delivering on Customer-Centricity

These solutions built to enhance and extend the value of 3D assets could potentially go a long way towards putting customers at the heart of fashion’s DPC output. Each of the founders I spoke with for this article counts diversity and accessibility as key benefits to their solutions, by removing entry barriers to digitally designing products or picturing themselves in them.

Speaking to Musandu about the consumer value of their lifelike AI avatars, he explains, “…if you show more representation… let’s say more skin complexions, more body sizes and more age categories, you are now representing more of your markets, which means that you can actually support the purchase decision”. Another key strategic objective where digital product creation can return significant value in an indirect way.

On the other hand, Drippy and SWOP (both startups in the Beyond Form portfolio) see immense value in co-creating with their users. “Brands and designers…can then see them as collaborators or partners rather than just customers,” explains Bagge. “Imagine if you can say I designed the shirt I am wearing with [a brand like] Hugo Boss.”

These examples touch upon the importance of where “enriching” solutions sit within the wider DPC ecosystem, actually welcoming end customers into the process in a way that’s only possible through digital tools. By amplifying the reach of 3D products, these technologies can open new dialogues with consumers that help align not just products but entire brands with their market.

The Value of Market Feedback Loops

“Now, the question is not “should we” BUT “how to” incorporate customers into the product creation process and what incentives can be offered.” states Nguyen – and I couldn’t agree more.

So, how do brands fold customers into the DPC process? What does it mean, in practice, to align DPC strategies with the common business objective of serving the market the best way possible?

FF created by Mast Studio, SWOP

According to everyone I interviewed for this story – as well as experience from across The Interline’s team – it will require the creation of robust feedback loops that guide internal teams to build, measure, and learn from market interactions with their digital assets.

By developing 3D designs, positioning them in the market, and learning from performance, brands can begin to validate their ideas and iteratively refine products, eventually moving away from staggered upstream design and development workflows.

And it’s essential to emphasise where this is already happening. Lalaland, for example, can help brands acquire market insights through their avatars. Visualising e-commerce customers can help track a particular interest in specific products more geographically and granularly.

Then, there’s also the opportunity to build feedback loops that inform on-demand models. Bagge tells me a core goal for SWOP is “aligning production more closely with consumer preferences and reducing the environmental impact associated with excess inventory.”

PuffPuff created by XYZ Studio, SWOP

Ultimately, feedback loops should spur brands to actively begin designing for, alongside, and in response to their customers by providing insights at multiple points of their interaction with 3D designs.

Personalised Workflows

In 2023, not only have DPC tools matured, but they also increasingly work together in tandem = as evidenced by the partnerships you’ll see by browsing the technology vendor section of this report. These solutions that provide additional market purpose to digital assets have strategically focused on making themselves as easy as possible to integrate into existing workflows – taking the form of plug-ins and cloud-based platforms.

Nguyen, however, makes an excellent argument about the state of Fashion DPC workflows in comparison to other creative sectors. “We already have Figma for UI/UX design, Canva for graphic design, and Webflow/Framer for website development….However, it is interesting to note that the fashion industry has yet to see a similar platform that caters specifically to its needs.”

The dream, then, might be a centralised platform with a collaborative interface and an asset library that could help internal teams and end users speak the same aesthetic languages, at the same time as allowing brands to tailor 3D designs for different upstream and outputs, garner insights, and interact with consumers.

Show time #2 by Mast Studio, SWOP

But this is just one piece of the puzzle; implementation requires a holistic overview of the bigger picture and a clear intention for the DPC process brands are trying to create. Adopting technology for technology’s sake will not deliver the desired results. Instead, internal teams must continue to personalise their workflows and adopt solutions that match the needs of their organisations and their markets. It does no one any good to work at either end of the spectrum, as siloed or chaotic teams.

When we look forward to an era of 3D working and digital product creation that moves on from the initial rush and into the true scale and multi-pronged ROI, openness to iterative and collaborative design will need to be encouraged across the fashion industry. The next year may look bleak from an economic perspective, and it may seem daunting to take risks and experiment with new approaches, but for many brands, 3D designs will exist regardless because they have become so foundationally important to the way those brands operate. And luckily, there is now a rich tapestry of tools out there, ready to help brands, designers, and creators use these assets in dynamic and market-driven ways, and to realise additional value from them that goes far beyond the narrow purpose of virtual sampling.