This article was originally published in The Interline’s second Sustainability Report. To read other opinion pieces, exclusive editorials, and detailed profiles and interviews with key vendors, download the full Sustainability Report 2023 completely free of charge and ungated.

Fashion, for outsiders, is known for its glamorous marketing campaigns and increasingly, for its sub par upstream working conditions and sustainability challenges – not necessarily for its technical job opportunities. For anyone looking to forge a career in technology, the Silicon Valley Big Tech sector would be the more obvious choice.

But, in order to meet net-zero goals, fashion is in desperate need of new technical talent, and lots of it. Upending a trillion dollar supply chain is no small undertaking, and modelling and mitigating environmental and social impact will require the brightest minds to capitalise on a broad spectrum of opportunities (from the fundamentals of systems and data science to the frontiers of AI) to redesign the fashion value chain.

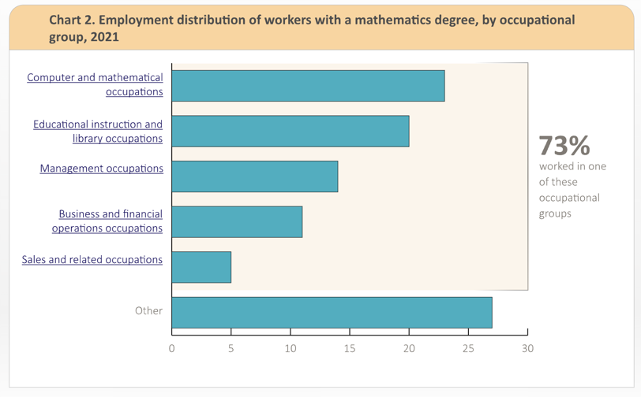

So there’s a big gap to bridge if the industry is going to accomplish its aims – and it’s a gap that will be difficult, if not impossible, to bridge if fashion does not make itself into a more attractive sector for the most sought-after talent. Today, the majority of technically skilled college graduates (physics, mathematics, computer science, chemistry) find jobs in consulting, finance, big tech or academia. Not fashion.

To put the figures into context: it is estimated that less than 1% of maths graduates go on to work in the fashion industry, despite a significant demand for those skills. Please note that indirectly, this number is higher, since the graduates ending up in tech and consulting do work for the fashion industry indirectly.

Overall, then, fashion is lacking tech talent. This is not the same as saying there aren’t brilliant tech people working in fashion right now – but from a whole-industry perspective, there are not nearly enough of them.

While fashion investments in tech talent have been lagging behind, fashion has been investing in technology as a whole: based on 2021 data, $16.2 billion was invested in downstream-oriented tech by fashion according to The Business of Fashion and McKinsey. Around 55% of these investments went towards ecommerce technology, while the rest was mostly put into payments technology, buy-now-pay-later tech and social commerce [²].

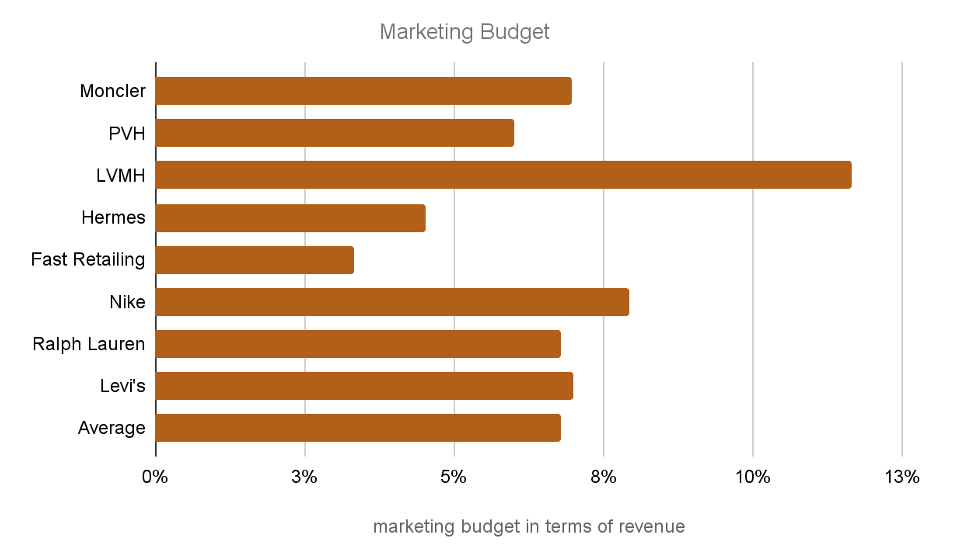

But IT spending is still a fraction of consumer-facing and marketing spend in the fashion industry.

*Marketing budget in this case often refers to ads expenditure, although it is not singularly defined so in (annual) reports. LVMH ad expenditures, for example, are estimated around 10.5 billion euros. As per their own annual report, marketing and selling expenditures are 36% of revenue.

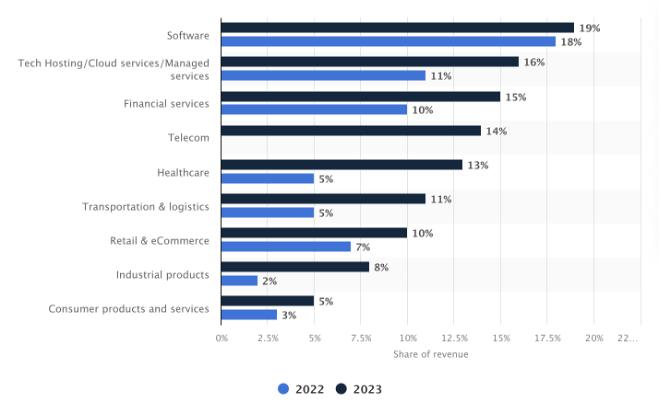

On average, big fashion houses allocate around 7% of their revenue to IT expenditures. LVHM allocates a royal 12% of revenue to marketing, while they allocate a mere 1.4% to IT [³]. In 2021, fashion brands, on average, allocated between 1.6% and 1.8% of their revenues in technology. By 2030, that figure is expected to rise to between 3.0 and 3.5 percent [⁴].

An average IT revenue share of 1.7% puts fashion behind IT spending in other industries. Little data is available on IT revenue share for manufacturers, this quite possibly could be higher than 1.7%, since production hardware and process and efficiency overhauls tend to be more costly than pure software initiatives.

To help solve the sustainability crisis in fashion, IT spending as a percentage of revenue perhaps should be closer to 10%, given how tightly linked the capture and usage of upstream data are to the industry’s need to understand and control its impact.

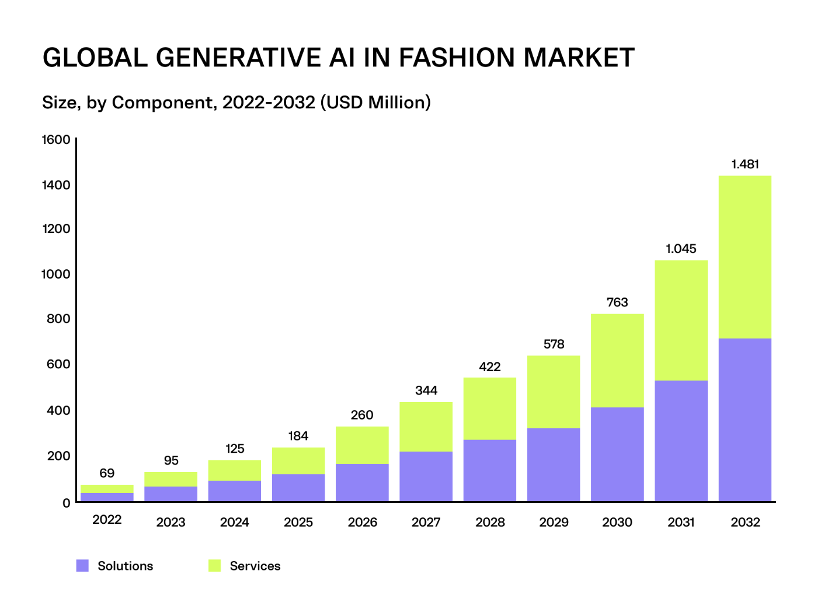

According to the latest industry report by Market.us, generative AI spending will display a CAGR of 37% in the next nine years [⁶], suggesting that fashion will indeed significantly amp up its technology investments.

But who and what to invest in? The recent developments in AI have drastically changed the technical labour landscape. A good deal of programming can now be done by one architect, instead of two junior developers. Just a technical degree is not sufficient. What kind of skillset and experience is required to effectively find and implement innovation in the supply chain? Which minds can capitalise on the automation opportunities AI offers? Fashion needs more (tech) people who can enforce systemic change, rather than just efficiency gains.

And this is not just a hiring spree for acquiring new talent, fashion can also upskill its current staff to take advantage of these possibilities.

What are the best use cases for new tech? What’s the financial impact? What should these new hires focus on? There’s the popular, outwardly-visible side of fashion tech – the metaverse, e-com tech, virtual try-ons, AI filters. And then there’s the not so popular side of fashion tech: the supply chain. It just doesn’t have the same ring to it. But it’s where the biggest decarbonisation and transformation opportunities lie.

In order to meet net-zero goals, the fashion industry has to simultaneously tackle more sustainable material production, implement renewable energy in factories, ensure lower overproduction volumes, more sustainable transport, better EOL practices, and more efficient recycling practices to name a few. These issues won’t be solved overnight, but in order to solve them we need the best and brightest – many of them.

More budget allocation towards (people in) IT only solves part of the problem. How do we convince these graduates to work for the fashion industry, not Big Tech? Fashion, from a financial standpoint, is not the most attractive industry to work for technically skilled people.

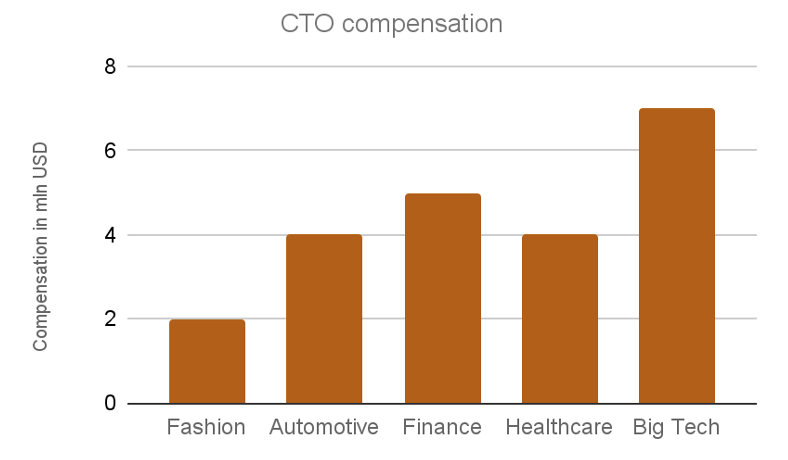

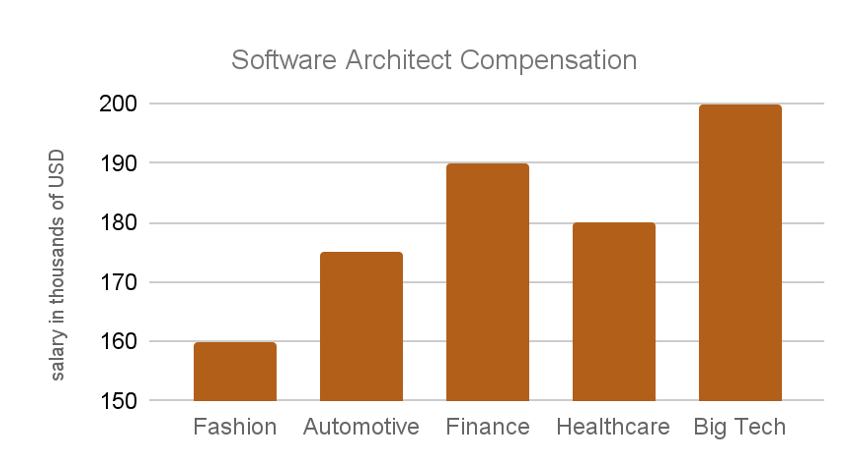

*please note these are very rough numbers, remuneration consists of different aspects (salary, bonus, stocks etc.), these figures represent compensation in big corporations. Based on Equilar, Salary, Cowen Partners, Motion Recruitment, Comparably data.

CTO salaries (not unsurprisingly) are highest in big tech companies. But they’re also higher in automotive, healthcare, and finance.

A software architect (again not surprisingly) stands to make the most in big tech. Like CTO’s, software architects are paid substantially more in other industries.

So maybe the IT budget shouldn’t be allocated to merely hiring more technical people, but also to paying (existing) technical people in these companies a more competitive salary.

Now, remuneration isn’t the full picture. It’s quite possible that technical graduates aren’t aware of the positive (environmental) impact they could have while working in the fashion industry. While estimates vary, the fashion industry is responsible for 2%[⁸]-10%[⁹] of global GHG emissions – there’s a lot of progress to be made. For an industry that’s selling and transporting roughly 184 billion garments per year [¹⁰], an incremental improvement in one area could have a substantial effect on the whole industry, and in turn, the whole world.

Phenomenal technical progress has been made in the past few years in the fashion industry, but we need more phenomenal progress, in more areas of fashion – especially those areas where the industry is facing external regulation and disclosure requirements.

Fashion can no longer afford to focus the majority of its budget on the beautiful side of fashion – marketing, we need to shift the (financial and HR) focus to the ugly side: the supply chain, if we want a fighting chance of meeting net zero goals while maintaining profitability.

Sources:

- https://www.bls.gov/ooh/field-of-degree/mathematics/mathematics-field-of-degree.htm

- https://www.businessoffashion.com/articles/technology/state-of-fashion-technology-report-investment-capital-funding/

- https://www.globaldata.com/store/report/moet-hennessy-louis-vuitton-se-enterprise-tech-analysis/

- https://www.mckinsey.com/industries/retail/our-insights/state-of-fashion-technology-report-2022

- https://www.statista.com/statistics/1105798/it-spending-share-revenue-by-industry/

- https://market.us/report/generative-ai-in-fashion-market/

- https://computools.com/fashion-technology-trends/

- https://apparelimpact.org/resources/roadmap-to-net-zero-report-2021/

- https://www.europarl.europa.eu/topics/en/article/20201208STO93327/the-impact-of-textile-production-and-waste-on-the-environment-infographics

- https://www.statista.com/outlook/cmo/apparel/worldwide#volume