Released in The Interline’s DPC Report 2024, this executive interview is one of a nine-part series that sees The Interline quiz executives from major DPC companies on the evolution of 3D and digital product creation tools and workflows, and ask their opinions on what the future holds for the the extended possibilities of digital assets.

For more on digital product creation in fashion, download the full DPC Report 2024 completely free of charge and ungated.

Key Takeaways:

- While the allure of AI is undeniable, Digital Product Creation (DPC) remains a critical foundation for broader initiatives like sustainability and traceability. DPC’s value proposition lies in its ability to serve the entire supply chain, enabling downstream production efficiencies and ultimately driving key performance indicators (KPIs).

- A connected data and content pipeline is essential for DPC success, enabling informed decision-making and efficient workflows. However, brands should be wary of hype surrounding all-in-one solutions and immediate AI adoption. AI requires significant investment in experimentation, tuning, and oversight, which may not be feasible for resource-constrained businesses.

- The DPC landscape is evolving beyond product visualisation and prototyping. Brands are increasingly recognising the value of digital asset management (DAM) as a program, not just a project, connecting data sources and systems to optimise content for various downstream applications, including merchandising, line planning, and e-commerce.

- Unrealistic expectations and a lack of universal buy-in hinder the adoption of digital-first DPC workflows. Trust in 3D assets remains a challenge due to the intangible nature of digital files and limitations in consumer visualisation tools. Addressing these challenges requires a crawl-walk-run approach, emphasising long-term vision and iterative progress.

In a difficult climate for fashion (and retail in general) new and ongoing investments in tech and talent-intensive initiatives like digital product creation can be harder to justify – especially compared to newer, hotter topics like AI. Do you believe the business case for 3D / DPC is strong enough? And how is that business case evolving to meet a changing industry?

The business case for DPC by itself can be difficult to prioritize for a number of reasons. Having said that, DPC is a foundational prerequisite for many of the broader initiatives that brands are investing in like sustainability and traceability. There is definite risk in being distracted by popular trends like AI, however business cases should always be grounded in outcomes vs. technology benefits and job aides. The key for DPC justifications is to represent its role serving the entire integrate supply chain. DPC teams can be perceived to be small groups in comparison to other areas of the business, but they are a lynchpin to unlock KPIs that are activated further downstream in the production pipeline.

In terms of the evolution of the business case as the industry changes, I would say that trends remain cyclical but the expected outcomes remain constant. Satisfying consumer demands remains the quintessential objective and DPC plays a pivotal role in activating the production process agility to respond to those evolving consumer preferences.

Taking account of that economic context, what do you believe are the strictly necessary or must-have parts of the DPC capability umbrella today, and which are more driven by hype, with longer timelines to a less certain return?

A connected data and content pipeline is a DPC capability necessity. One of the biggest challenges that most brands have today is how fragmented data & content stores are. Key operational data lives in a PLM or a MDM system or worse in Smartsheet & Excel and the product imagery and virtualized material libraries live in shared drives, SharePoint or some other disconnected repository. There is no governance or version assurance or validation of the accurate information in which to make informed decisions.

The two areas of hype that I would caution the readers on are systems that represent a myopic view where all operational data and workstream tasks can be performed in one unified application experience. That simply isn’t feasible for most organizations’ operating models. Either system access is restricted to a only a subset of process contributors or the limitations of that centralized system require brands to conform the way they work to the rigid system design. The second hype that I caution readers to contemplate is the immediate value of AI adoption. Most organizations are being forced to “do more with less” and they believe AI gives them the immediate fulfilment of this proposition. The truth is that most AI services require experimentation, tuning, and most importantly oversight.

Oversight that requires staffing assignment and training. If headcount and competency gaps exist today, the adoption of AI isn’t going alleviate the pressure in short term.

From your perspective, what have been the major shifts in the DPC landscape this year beyond the economic context? How have you seen your clients, or the wider industry, thinking differently about digital assets and workflows?

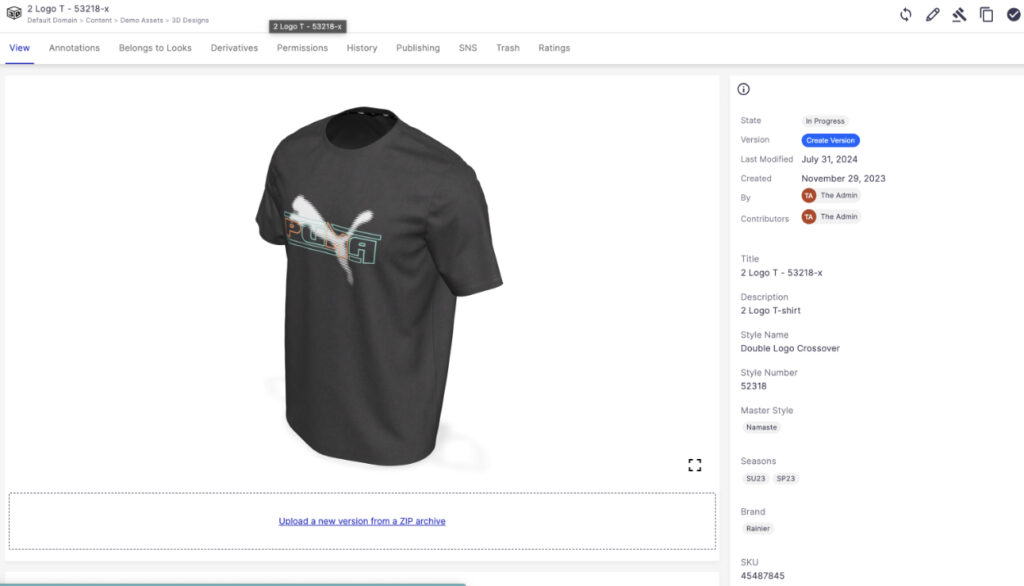

I believe firms are starting to recognize DPC is more than just about design tools and product visualization. They are starting to recognize that a 3D package is one of the most valuable assets an organization can produce because all of the ways a 3D package can be leveraged across the end-to-end supply chain from ideation to eCommerce.

Our most successful clients see digital asset management as a program and not a project. They are transforming the way their organizations view DAM as not just a file management application, but as a digital backbone that connects various data sources and system applications to curate virtualized content and make those artifacts actionable and optimized for syndication.

The early phases of DPC seemed to focus on proto-typing and sample reduction, but in the last year there has been a propensity to think beyond just content creation into content orchestration, merchandising, line planning and other downstream consumption channels.

The challenge of creating a digital-first culture, a 3D pipeline, and a content ecosystem around a single product category can be significant. But for multi-category brands – especially those that cover not just apparel and footwear, but accessories, cosmetics and other packaged goods – that challenge can be multiplied several-fold. What are you seeing emerging as the right way to tackle DPC initiatives for companies with a wider spread of products?

I don’t think there is a one size fits all approach or the “right way” to tackle DPC initiatives. The issue that many multi-category brands have is a lack of consistency of process and applications. Ideally, a DPC initiative introduces standards, governance and core operating principles. That’s difficult to achieve and to reconcile if each team is using a different application, views a different system as the source of truth and feels processing procedures are unique to their individual function.

An emerging practice that we are seeing that establishes the proper alignment has two key pieces: Senior-level sponsorship and the creation of a mission statement for the DPC initiative. The mission statement serves as baseline of what we are solving for and gives the teams a sense of “what’s in it for me.” Change management remains one of the biggest hurdles in any enterprise initiative. One way of mitigating change management resistance is establishing “what’s in it” for the core stakeholders involved and the reinforcement from Senior level sponsorship of the DPC program’s corporate benefits.

What do you believe is standing in the way of companies adopting digital-first DPC workflows? Where is trust in 3D assets falling down?

Unrealistic expectations is what’s standing in the way of companies adopting digital-first DPC workflows. Whether its quality control standards or physical production preferences or a resistance to change, many organizations lack the universal buy-in for the digital transformation. 3D is not perfect and does not lend itself easily to every production stage for every product category. Whereas the advantages over traditional physical production or 2D digital workflows are tangible, it is often not sufficient for the immediate Return on Investment demands that many brands have.

Digital-first DPC workflows should follow the crawl-walk-run philosophy. The transformation and benefit return is not going to happen overnight and shouldn’t be measured on short-term gains.

The trust issues with 3D assets stem from the fact that it’s a digital file. You can’t touch the digital twin. You can’t inspect the quality or craftsmanship of the replica and most citizen consumers don’t have optimized visualization tools to leverage when interacting with the assets so the representation of the digital twin aren’t enhanced.

To realise the long-term vision for a complete “digital twin,” it should be possible for any decision across the extended product lifecycle to be made based on a digital representation of the physical asset, with total trust. Which of those decisions do you think meet that high bar today? And which do you believe has the furthest distance to travel?

Our expertise isn’t based on every decision that is made across the extended product lifecycle but we would say that data driven decisions are most pertinent and decisions that are judgement oriented have the furthest distance to travel. For instance, data driven decisions around consumer demand, supply and inventory management, concept and design specification, and assortment planning are all immediately applicable. Decisions around fit testing, durability, color saturation all have accuracy and authenticity hurdles to still navigate. As the industry and technology advancements continue, the distance will naturally shorten but long-term vision for a complete digital twin remains a ways off for apparel and footwear providers particularly.