Welcome back to the Interline Podcast. If you’re starting off 2026 with AI fatigue, I think that’s pretty understandable. Last year was absolutely swarming with new use cases and new ideas about where to put artificial intelligence. But in reality, the widest and the deepest uptake of AI might actually be for one of the oldest ideas: selling things.

We’ve recently finished a holiday season where AI, in particular large language models, influenced significantly more purchases than even most optimistic analysts had predicted. Based on The Interline’s own traffic patterns, as well as what we’re told by brands and retailers, AI as a referral source for websites, and specifically for e-commerce storefronts, is definitely on the rise. And in response, we’re now hearing a lot more about GEO (Generative Engine Optimisation) and AEO (Answer Engine Optimisation) than we are about traditional search strategies.

But how ready is any of this for prime time? How ready are we to actually replace search with a completely different model? How justifiable is the energy that online fashion brands and retailers are expending, or are going to have to expend, on optimising for a new age of the web if that new age is going to spend the rest of this year, and potentially even more time, being just around the corner or ready any day now?

Weekly discussions, debates, and technology insights for fashion and beauty professionals, hosted by The Interline’s Editor-in-Chief, Ben Hanson.

Find daily editorials, reports, analysis, and stories at The Interline.

AI agents, agentic browsers, and language models equipped with tools – a new cohort of artificial shoppers could be on the horizon. But can the technology and the incentives scale fast enough to justify the returns for retailers and brands?

To find out, Ben talks to Jonathan Arena, Co-Founder of New Generation.

This episode represents the second time in the last couple of months that we’ve dipped our toes into the AI shopping waters. We previously spoke to Maria Belousova, who’s the CTO of Daydream. And my guest this week is Jonathan Arena, the Co-Founder & Chief Product Officer of New Generation, a software company that builds the storefront layer for AI commerce. When AI starts doing the shopping, New Generation’s aim is to make sure your brand is ready

Jonathan has some fascinating insider perspectives on the real scale of the opportunity in AI shopping. And he’s also got some pragmatic takes on the timeline and the amount of work involved in executing what could be the biggest step change in selling since the advent of e-commerce itself.

Listen to the latest episodes / subscribe below, or read on for the full transcript.

Never miss an episode

Get notifications for new podcast episodes, plus our weekly news analysis, events, and more, delivered straight to your inbox.

NB. The transcript below has been lightly edited.

Okay, Jonathan Arena, welcome to the Interline Podcast.

Thanks so much for having me, Ben. I’m excited to get into it.

Absolutely. So let’s start by setting a baseline when it comes to where e-commerce in general stands today. What do you see as the state of e-commerce for fashion at a whole industry level, where we stand now at the beginning of 2026? What does the typical tech stack look like for either retailers or brands with direct-to-consumer e-commerce stores? And which of the different elements of the online shopping experience do you think brands and retailers have indexed on the most prominently? What defines e-commerce right now?

Boy, well I think there’s two ways you could answer that question. One is from the insider’s POV, you know, as a retailer or merchandiser, a technologist working at a brand, and then the other is as a consumer.

Maybe we’ll start with the first one. I would actually say the first thing as a case in point here is, we are talking with a large global beauty retailer right now. And I think they were using 47 different technology providers across their stack. And that’s everything from PIM – logistics, inventory management, the catalog, kind of deployment of the front end. So I think that is a good example that is indicative of a lot of large global retailers or that size of retailer, which is the state of the tech stack as fragmented. It is unwieldy at times, extremely hard to manage, distributed, and I would say we hear a lot that the data and the information systems that connect the data, all those things are very hard to manage.

Yeah. Thinking about the same kinds of retailers, what do you think they’ve used as their kind of operating and driving principles for what they want to deliver with e-commerce? Have they focused on frictionless experience? Have they focused on breadth of selection? Have they focused on that fulfillment piece, the rapid turnaround? I’m keen to get that insider’s POV because – and we will come onto the consumer thing in a minute – that insider’s POV on what it is that those kinds of big companies are really trying to do with their e-commerce storefronts.

Yeah, I think this is a good question. We could probably spend a lot of time unpacking it. But I think maybe two things come to mind. The first is I would say that a lot of these decisions, like the root decision, were made quite a while ago. If you’re a brand and you’ve been around for quite some time, I don’t think you’ve had the opportunity to really make a new set of decisions around your tech stack to optimise for new opportunities.

And what I mean by that is we hear a lot that it’s Salesforce cloud, it’s Magento, it’s Shopify perhaps, maybe they’re coming, going up market a bit, but I think what they’re trying to optimise for is at least today, end of 2025/beginning of 2026, data quality as a means to provide more accurate information around inventory, and kind of real time insight into products.

I think a lot of times there’s a lot of navel-gazing internally around business problems rather than customer problems. So you could probably look at it in both of those lenses as well. The business problems, the company problems are margin compression, tariffs, they’re trying to reduce overhead, obviously they’re trying to serve experiences that increase AOV or conversion. And they’re trying to get their tech stack to point in that direction at a high level. Of course, they are also trying to serve customers. And that’s where the data wrangling – connecting information about user behavior on the front end, account creation and storing PII data for customers – that’s where they’re trying to take the data piece of that and connect it to their systems and hopefully form fit the capabilities of their existing tech stack to try to meet the opportunity that we all see as emerging, which is AI experiences, hyper personalisation, GEO and AEO, all that stuff.

So I think that there’s a real cloud of opportunity and problems that they’re trying to solve with their current tech stack and the summary I would say is they’re trying to push their tech stack to be able to meet the moment as best that they can and try to wrangle the data to also do the same.

Yeah, I think you said something interesting there, which I’ve heard before, which is a lot of e-commerce infrastructure and a lot of e-commerce strategies and initiatives, they all began life a long time ago. They began in the first wave of selling online. In some cases, they were from brands or retailers who were proactive and had the foresight to get ahead of the curve. In a lot of cases, they were reactive. Famously, there were a lot of brands that were late to selling online and then had to develop around there. And I think trying to make that conform to another new era is going to create a lot of pressure internally when it comes to figuring out what brands or retailers can actually deliver with the tools that they have and what it is that they might need to build or buy to enable them to ‘meet the moment’ as you put it.

Yeah, okay, I love this and I hope we get back to the builder by conversation because there’s a lot there to discuss. But I think you’re absolutely right. That feeling of the tech stack, the feeling of the meeting of this opportunity, you know yet another wave. Okay, it was like: get online, build an online store. What tech sector do you use? OK, mobile, OK social commerce, OK, TikTok shopping. It’s like this never ending tech innovation curve that everyone has to kind of metabolise.

But I feel like there’s a lot of overwhelm with AI right now on the retail side in a way that we haven’t really seen. With a lot of the other waves I just mentioned, you could readily use your existing tech stack. I think a crude but fair statement would be: the online store hasn’t really changed a lot in 20 years. Okay, yes, maybe the form factor being pushed to mobile, there was a lot of effort that went into that and responsive sites and pixel tracking for social and all that stuff. But the form factor and the workflow and the ergonomics of that whole thing has been fairly consistent. AI, on the other hand: a completely different animal. And so the consequence of that is, which we’ll maybe get into, but the consequence emotionally is there’s an overload of noise.

Yeah. And I do want to get into that. And I think I’ll pick that apart in a specific question in a minute. For now though, we’ve got a perspective on what we think e-comm looks like from the insider’s POV. You mentioned the other one, the shopper. Where do you think online shoppers are dissatisfied with the way things currently stand?

Now I had the CTO of Daydream on the show late last year and she identified fragmentation of the journey. You’ve just talked about fragmentation of the tech stack for the retailer. But fragmentation of the journey, all the different touch points, all the different channels that are available to the consumer and a persistent lack of personalisation as being two of the big issues for consumers. And I think she also mentioned the same thing you did, which was a lot of this has roots in the fact that e-commerce has been fairly static in form and function for a very long time.

Would you agree with those? Fragmentation of the journey and persistent lack of personalisation? And what else do you think is in the way from the shopper’s point of view of delivering the right e-commerce experience?

Yeah, Julie Bornstein, she’s great. Daydream’s exciting. She knows a lot. She knows what she’s talking about. So I would have to agree with her on those two comments that she made. I would say the fragmentation of the user journey is interesting. I always think about the consumer lens here as kind of reducing down to one: convenience. We’re all strapped for time. A lot of the time the prevailing mentality when shopping or researching products or trying to buy things comes down to convenience.

And I think another thing I would call out would be maybe the way I would say it is a lot of people love shopping and they love discovering new features and they do like spec comparison and they fall in love with brands. And there’s a richness to the internet, at least the past 20 years, where brand expression has been a really fun part of going from website to website. How do they tell a story? What materials do they use? What do they stand for? What does that mean for me when I’m a customer? And so I think that a friction point for customers right now is, every website kind of looks the same. I actually feel like, again, this is a general statement, but there’s been a lot of compression in that because the tech stacks have homogenised and the templates have homogenised and the carousels have homogenised. If you squint at a website and you don’t look at the logo in the upper left-hand corner, it’s kind of hard to tell which website you’re shopping on.

I think maybe the last thing I would say is a personal frustration and maybe this is a bit of the fragmentation piece Julie mentioned from a shopper journey perspective is that I don’t feel like I get rewarded with loyalty to a brand today. Primarily because my point of purchase is very fragmented. I maybe buy things from a brand on Amazon or on a marketplace or maybe on the website itself. But now I have credential management in three places, maybe it’s 10 places. My account and my interactions with that brand are fragmented. A lot of times I go to Nike’s website and I buy Nike shoes. Nike doesn’t know who I am. It forces you to sign in. I think all of that, it’s a little bit of friction in the journey and it’s a lack of personalisation that can follow me around the internet.

Yeah. And if you have that sameness and friction together, then you’re not creating memorable experiences in the same way that I think a lot of retailers would say was their original ambition with any new channel, right? Obviously it’s something that’s been done with physical stores for a very long time. Social, mobile, e-comm, I think everybody would say, we’re trying to create a different and memorable touch point. It does seem like it’s converged on being a bit of a pain in the ass a lot of the time to shop online and also not that memorable as a result.

Yeah, I wouldn’t speak for other people, but it doesn’t feel like it’s as good as it can be, right? I think it’s kind of ‘meh’.

Yeah. That’s a pretty good assessment. Just as an FYI, it was actually Maria Belousova, the CTO of Daydream rather than Julie Bornstein, but they work pretty closely together, both very intelligent people who have a good perspective on that.

Oh, I’m sure.

Let’s talk about the scale of the AI opportunity then, as you see it here. So according to Adobe’s most recent holiday retail analysis, I think they run every year,

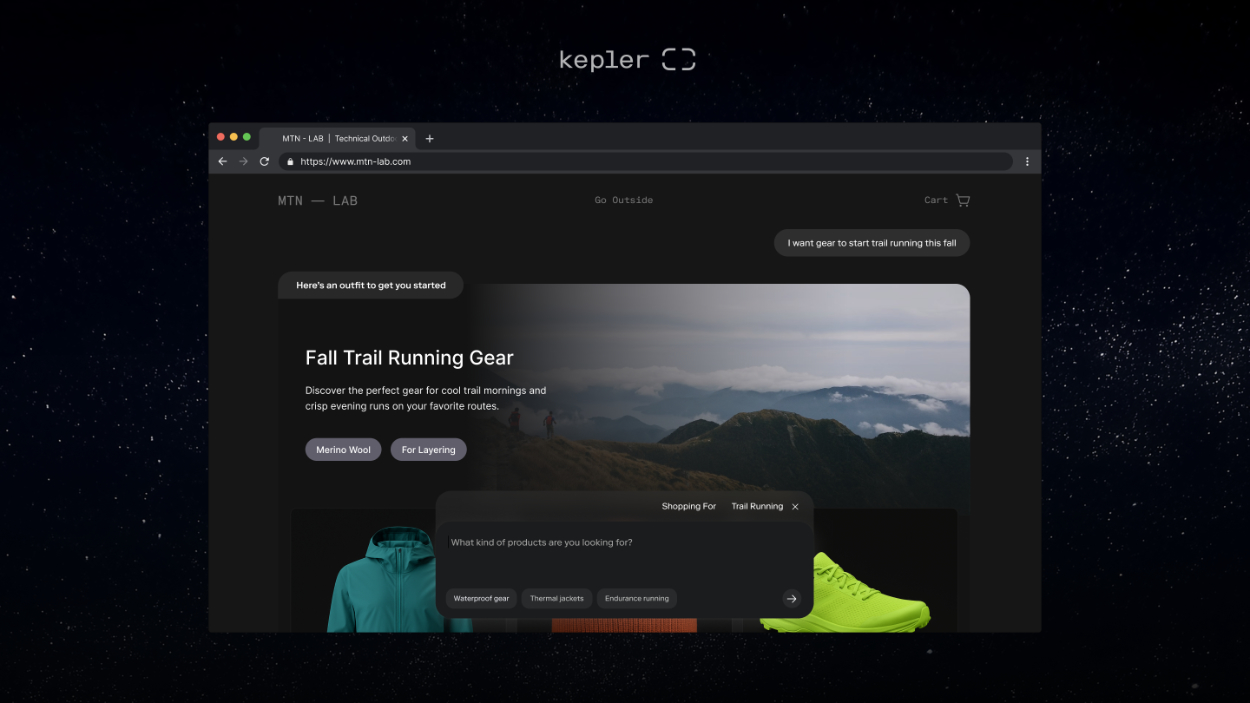

AI referrals to retail storefronts were up more than 750% year over year in what they define as like the Black Friday period. So I think 1st November 2025 to 1st of December 2025. I know from looking at the New Generation in Kepler page, you have an even higher percentage figure on your own website to evidence the growth of AI in influencing shopper behaviors.

Those are big numbers. They sound like a major shift, especially when you stack them alongside the much steadier ascent of mobile as the primary channel for shopping versus desktop. Relative percentage increases can sound really exciting, but they can also be deceiving. And I personally find it difficult at the moment to get a handle on the true scale of AI usage. Not from a kind of “ChatGPT has 800 million weekly users” or whatever. That’s clearly a lot. But from the perspective of a retailer, how much traffic is coming their way from AI.

Now, the reference frame I’ve got for it is that as a publisher, AI as a traffic source accounts for about 5% of our total at the moment. I’m measuring that in a very crude way using web analytics and referral channels directly from ChatGPT and Perplexity and similar, which is obviously not nothing, but it’s not a primary referral channel for us. It’s not a primary source of traffic. And also, when you’re dealing with small percentages like that, it doesn’t take a lot to get to a hundred percent uplift year over year.

So help me to better understand the scale that you see of the AI shift in online shopping in some more concrete terms. You know, what data did you see in the market? Or, what are you observing in your engagement with customers that gives you the confidence that AI is going to become an important channel in its own right?

I think what you said is important, which is: this is relative growth. It really depends, when you look at all this data, on what you’re comparing it to as incremental improvement, right? So 700%, 4000%, it depends on the time duration, all those things. So the point is true that yes, there’s a lot of incremental growth, exponential growth in fact from AI surfaces to retail brand websites per Adobe and other companies. That makes sense, though. I actually don’t think that’s that shocking. It makes sense because of the behaviour shift. You know, ChatGPT has 850 million weekly active users. So of course there’s a large shift and change in where the traffic is coming.

I think if you think about the volume and scale and magnitude of this, I think about it in a couple of ways. One is a study that ChatGPT actually did on what people are searching for and talking about in ChatGPT. They published this last year, and at the time they published it, I think they cited something like 2% of all conversations were about shopping and that that was growing. So that also seems kind of small relative to the percentage of Google keyword searches that were commerce or shopping related. So what that tells me is, number one, a lot of these LLM platforms don’t yet have robust commerce infrastructure or interfaces. They are starting, we’ve seen a lot of them come online, but it’s very, very early and far less mature than Google as the known ergonomic path to find websites and products on the internet.

If you look at the magnitude of ChatGPT’s daily conversation volume, and you say 2% of that already is about shopping and commerce, and then you look at the maturity of Google shopping and what percentage of that was shopping and commerce related. You can quickly see that, oh, this is going to be unbelievably huge. Quickly, we’re going to get to 2 billion people in ChatGPT. Quickly, we’re going to get to 5-10 % are shopping and commerce related conversations as this ecosystem matures. So that’s going to turn into exponential growth for your own traffic coming from these sources.

So that’s one way I think about it. Another way I think about it is, and this is a little cheeky, but I think it’s true: the more realistic way to define AI sources is, if it’s a human shopper, I would consider anyone (except for the most out of touch, I wouldn’t call them the Luddites, but). Pretty much everybody now is an AI shopper. I think that’s the way to say it. Even if you’re not coming from ChatGPT, you are an AI shopper. Why? Because you are now used to natural language search as the interaction model. You are used to surfaces that are intelligent and can give you instant answers. And so if you look at a website that has 200 million monthly visitors, like IKEA, there’s a large percentage of those people, even if they’re not coming directly from ChatGPT, that might as well be, in terms of the expectations they have.

I think that’s right. I think the scale of the ChatGPT user base is what it is. The behavioural impact of the rollout of ChatGPT specifically, but obviously, you know, the broader cohort of LLMs as they stand now, that’s much broader. It conditions everybody to think differently, to search differently. AI mode becoming, if not the primary mode, the secondary mode of search, very quickly gets you to where I think you’re correct. Even if somebody is not coming from ChatGPT as an app, the way that that is influencing and governing how they interact with search and product discovery and everything else is profound. And I think that’s going to manifest itself in a pretty meaningful way this year and beyond.

Yeah, I mean, let’s try to get even more precise about it. The reason why people care about referral source is so they can figure out how to rank higher in that original source. So they get more organic traffic or in the future more paid traffic. But I think it’s true what you said also that AI mode, let’s use that term, AI mode is going to be like the entire internet before we know it.

And so the reason why you care about that traffic source is so you can meet that customer in a way that creates a smooth user journey. And so the case in point being that everybody’s in AI mode anyway.

Mm-hmm. I think that’s right. Then I want to contrast that a little bit with some of the immaturity of the platform side of things and maybe the immaturity of the application side of stuff that you mentioned before. Because what we’ve been talking about is referrals, right? We’ve been talking about users who get some way into the product discovery process using an application with an LLM behind it. And they then follow a link to a retailer storefront or they land on a PDP page and the transaction still happens in the brand or in the retailer’s world.

Is that still the dominant mode for how shoppers are interacting with AI for shopping tasks? Because I think the retail industry has a bigger fear here, which is that AI applications – which ChatGPT is the one we’ve been referencing, but Gemini is another good indicator here – are looking to break off a much bigger piece of the journey and to disintermediate retailers and brands in the process in the same way that you’re talking about AI mode becoming the web. If AI mode becomes the shopping infrastructure, there’s, I think, the fear that the brands and retailers cede ownership of a channel that is extremely important to them.

How justified is that concern? Do you think referrals, what we’re talking about now, is the start of AI exerting what’s gonna become a much broader influence over shopping and swallowing more of the journey en- to-end over time? Or is it going to remain primarily a referral channel the way social has been? Because referral channels sound like, as you said, opportunities rather than threats. AI taking over more of the shopping journey sounds more like a threat than an opportunity depending on where you stand.

Yeah, I would say, if you follow the money and you look at, let’s just take OpenAI. OpenAI brought in a very talented CEO of applications, Fidji Simo from Facebook, who has demonstrated an incredible ability to build advertising and commerce experiences across multiple companies. They need a way to monetise. OpenAI is burning cash and so shopping and commerce and things like percent GMV are obviously an easy way for them to make money.

Now we also have this technology that can scrape content from websites but what they’re trying to do is convince retailers to willingly give them their product data. So I think there is a dystopian worldview here where AI mode takes over and there are a few powerful platforms and then hundreds or thousands of long tail AI shopping surfaces where a customer never leaves that surface. And so you would expect to see a plummet in organic traffic going to websites. Whether the AI models say that they have an intent to disintermediate the brand or not is sort of irrelevant to how people will feel about it and the practical implementation of it, which would probably mean a huge question around who owns the relationship with the customer. So that’s the disintermediation.

So, right now, to answer your question, we’re still very early innings. Right now there is still incredible volume on the internet to retail brand websites. It hasn’t changed a lot. Maybe a little bit, but not a lot. And so my overall take here is that there is an unbelievable opportunity and an incredibly important task for all of retail to build what I would describe as like their own intelligence layer on their website, which is a little bit of what we’re doing at my company. But you need to own first party data if you’re a retailer. Or else you risk being compressed out and just being a carousel competing with other carousels in a giant AI mode shopping mall on the internet. I don’t think that’s the future that the retailers want. It’s certainly not the future that I as a consumer want, back to my whole point about brands and delight.

No, I would agree. And I also think, though, that in a way, given that we talked about the lack of differentiation and the lack of delight, for want of a better word, in e-commerce as it stands today, that’s almost online retailers’ game to lose if OpenAI and their peers can deliver a more memorable experience or just one that happens to be more convenient because it lives in applications where those people already are. That sort of, level of consolidation. So I think the opportunity that you’re describing – and we’ll get into how you go after it – is an opportunity to avoid that scenario that you’ve just described by making sure that your online storefront is ready for the next wave, as opposed to just letting it wash over you and suddenly discovering that you are part of a big, undifferentiated mass of online shopping.

Right, you do not have to be relegated to being a plugin in this big AI platform.

Yeah. Yeah. I think that’s a really good way to look at it, actually.

Now then, the one other thing that I just wanted to touch on when we’re talking about ChatGPT and so on is anyone who’s had some experience with the lack of maturity that we talked about within ChatGPT itself or with some of the agentic browsers, your Atlas, your Comet and whatever features are being added to Chrome these days. They’ll have found that those tools have fairly strong limits, whether that means there’s a point where you’re interacting with ChatGPT and you get bounced to an e-commerce storefront via a link or citation. Let’s assume that’s got some affiliate revenue in there in the longer term. And then you carry on the journey there. In an agentic browser, those sorts of limits mean that you’ve tried to delegate some or all of the shopping journey and the agent has reached a stage where it can’t continue with that intervention and you then as a consumer need to take over.

Having played with both of those deployments, my experience right now is that agentic AI as it currently exists in consumer products doesn’t work super well for a lot of purposes, but shopping for the one that’s in front of us. If you’re trying to discover or identify by something, a lot of the time it’s quicker, it’s more comprehensive and inclusive, it’s more accurate to do the work yourself.

Now, is that a limitation of the technology? Because I don’t want to sit here and say, well, AI is not fit for purpose. Agentic AI is not fit for purpose, because I don’t believe that. Is it instead a limitation of the data and the tools that LLMs can access when they go out to the open web to canvas e-commerce storefronts? What’s holding those kinds of things back at the moment? Inherent limitations to the way the tech works or limitations to the way that the databases are structured and the way that e-commerce storefronts are structured.

I think you’ve laid it out well. I think it’s a bit of both. I would give you a strong agree that the experiences to date have been underwhelming. But this is the nature of …these are all beta products. If we zoom out, AI is a beta technology, meaning it’s extremely early. All these things are like test pancakes for the tech companies. And so they are going to frustrate people. That’s how those companies are going to learn what to build, what to improve. It’s part of the process. So I would say as one way to underwrite what I’m about to say next is it’ll get there. Let’s have patience. Consider yourself an early user if you’re testing these deployments, as you said.

So you said two things, technology limitations inherently in the LLMs or like the tech and then a problem with the storefront and the data organisation and data structure. Both of those are true. If we start with the website, so the brands owned surface and owned data, here’s what we know. Number one, it’s still incredibly difficult to categorically identify agent traffic. It’s easy to identify some because some will literally tell you and declare who they are when they go to your website. Others do not. They actually intentionally obfuscate who they are. There’re big players who are trying to figure this whole thing out, namely Cloudflare, Akamai, CDN that a brand will use.

So there’s a lot of work right now to institute a methodology for identifying agents. And without getting into too much complexity, there are many different types of agents too with different behaviors. You know, there’s search agents, there’s crawlers, there’s agentic browsers. So the industry is trying to figure that out. Once those agents are identified, there’s another problem of how easy is it for an agent to answer the question they’ve been tasked with from the customer they’re serving. Meaning search bars today on e-commerce websites are keyword based, they’re not natural language based. Agents try to use, if you observe them, they actually try to use search bars and they will compress (this is very interesting) they will compress a long natural language paragraph given by a user into keywords, and they’ll try to put that into a search bar on a brand website. Because the agent knows that that’s the interaction that’s acceptable for that search bar. The data is a mess, you’re right. I think we talked to a lot of retailers where they’re still doing manual tagging. So that’s the process of associating a SKU with a keyword. Now we’re in the situation where you need to associate SKUs with natural language themes and conversation types. So that’s a problem.

I would say the third problem on the owned surface is the checkout. Again, a whole consortium of companies trying to figure out how to allow agents to successfully check out in a safe way through a brand-owned checkout flow. Obviously, there’s startups doing that, and there’s big companies like Visa and MasterCard, then the PSPs like Aiden and Stripe. My answer here is there’s going to be a consortium of players that need to work together to define how this is gonna work across the free range internet. So yes, TLDR, lots of problems to solve. I think that’s why I have a job. [Laughs]

Yeah. And I think one of the other things I talked to Maria from Daydream about last year was that challenge of bridging, you know, fuzzy semantic natural language search with the sort of objective attributes that typically exist in brand and retailers back end systems and databases. Very quick question on that one: is there any tension that you’ve seen within retailers between putting in the work to make their catalogs better suited to organic free flowing conversational queries versus maybe providing dedicated tools that AI agents can call through MCP or what have you that would allow them to directly query the database? And, I genuinely don’t know the answer to this, is the right way to think about it to say, well, the search bar is still the answer and what we need to do is to figure out ways to map that fuzzy stuff towards the objective criteria that people are actually looking for? Or is there an argument to be made for, well, let’s just open up our database through the equivalent of API calls for AI and allow AI models and agents to just simply interact with it on that basis and sidestep that whole query about translating natural language?

Yeah, this is a very interesting question. I think it’s at the root of the technology question too. So we have heard a lot of companies we talked to, they have fear and concerns about just giving free range access to agents. There’s good reasons for that. One, you don’t know, like I mentioned, necessarily which agent it is. You don’t know what they’re doing with the data, You lose a bit of merchandising control, which is critical because brands care about how they merchandise and represent their brands and how they tell their stories. And the equivalent here is what you’d be doing if you just let agents have full access to your data and now the interpretation of that content is fully in the control of the agent and the consumer behind the agent.

Yeah, that’s a fascinating way to put it.

Yeah, meaning the brand can’t control the story.

No, all they’re providing in that context is a catalogue.

Yeah, they’re literally just lying down and say, go look at the book. Here it is. That is not the posture that any of these brands have had. And so it’s worrisome.

The only equivalent I would push back on slightly would be that it maybe was the posture that some brands had when it came to their initial interactions with big marketplaces like Amazon, where they would say the volume that we get from this offsets the lack of control that we have.

Yeah, sure.

Okay, so you make a good point, right? The point here is what is the ROI? Like, why am I motivated to do something that is a lot of work and requires a lot of buy-in? Remember, I’m sure everybody in the audience probably knows this, but in big retail, global retail in particular, different divisions and orgs own different catalog verticals on the website. And there’s a lot of horizontal org alignment and buy-in, which is one of the things that contributes to slow planning cycles. And this year-long merchandising loop with the holidays and code freezes, everything is kind of slow. And so the onus or the burden to clear for investing in a radical change – like redoing your catalog in a certain way or changing it from keyword tagging to semantic mapping – you need a very, very clear, obvious, why am I gonna do this?

And so I don’t think it’s the search bar argument. This is actually a thing we encountered early on in our company where we learned pretty quickly, why does search on e-commerce websites, why does it suck? Nine times out of ten, if you type even the most basic natural language query into these search bars, it will return what you expect, which is sorry, we can’t find what you’re looking for, or the equivalent. It’s because there was never a real clear ROI to upgrade the search bar pre-LLMs, because we reached a local maxima in terms of the capability of the technology to deliver conversion or AOV or any of the top line retail metrics that they care about.

If I say one thing in this conversation that I hope is written down and you take back to your teams: we’re not talking about search bars or tools. We are talking about a restructuring of your catalog and embedding it and using and allowing LLM technology to take your brand into the future in the next year, five years, 10 years. This is a completely different shift. And so the ROI is going to be massive.

Mm hmm. Okay. And I think that’s really important framing, 100%.

One quick one. So we’re an online-only publication. So we think a lot about the future of the web. We publish articles every week and the primary mode that people engage with them is by directly interacting with a reasonably nicely designed front end. If they’re not using an RSS reader, which very few people do these days.

For online retailers, the same principle kind of applies because they are designing website front ends. It doesn’t matter really whether they contain writing or product descriptions that are intended to be human readable. What do you think the future is here? Do you predict that retailers will maintain one version of their websites for human visitors and have an entirely separate domain or sub domain for the different categories of AI visitor that you mentioned? Will they be making one website that’s just friendlier for all classes of visitors that’s got appeal and interactivity and has all of the requisite information structure for humans and agents? Is there some crossover in the middle where retailers are adding their own conversational interfaces to the surfaces that they own? This one is on my mind a lot as somebody who owns a website.

I think this is a really good question, and I have a clear answer, which is there’s finally a reason for brands to have an API, or now MCP access to their catalog, to their merchandising logic, to the way that they wanna express their brand. And because of that, the world that we’re moving into is a world where it’s not quite two websites, but it is certainly a human experiential website and an API or MCP based data website, or at least endpoint for agents and for AI.

And so I think it’s a little bit of a misnomer to say there will be a need for a brand to maintain two websites, rather there is a new access point with new tools and new intelligence that is exposed to agents and to LLMs in addition to continuing to maintain and hopefully maintain in a much easier, more thoughtful way with AI experience for customers.

So to summarise, one website, two surfaces or two access points for two very, very different stakeholder types.

Anything crossing that is where we diverge and say there is a human web and there is an agentic web and the two need to be curated differently.

I think they need to be and it’s actually a great thing because if you do research about why e-commerce websites are designed the way they are, some of the reasons are because they perform better for people. A lot of reasons are because that’s what worked for Google websites and the Google crawler 20 years ago. Tabulated pages, a hierarchical navigation taxonomy. A lot of that UI, those primitives, were designed for the Google crawler to tell it what the contents were available on that website. And so one of the nice opportunities I would say we have is you’re gonna get immediate benefits right now moving forward to architecting your data and cleaning your data and structuring it for agents and LLMs. And what that frees you up to do is now you can kind of worry less about the rigid structure of your existing website and you can create a customer human experience that is much more organic and conversational and can combine things like products and context and story and media in a way that you can navigate naturally with conversation rather than a predetermined checkout flow.

But an ultimate question, thinking about our readers/listeners who agree with you that there’s an opportunity to go after here and they determine that they want to go after it. It feels to me like the first step in doing that kind of optimisation for the AI era of the web is figuring out not just the scale of the AI traffic or where it’s coming from, but the actual composition of it.

So you mentioned it’s difficult to get insights into what agents are doing, but that feels like the first thing that I as a retailer would want to know, not just what application did somebody use, which model were they chatting with when they came over to my website, but specifically what was the nature of the query? Because that then seems like something that I would invest in optimising for – understanding how people are arriving at me, what level of the conversation are they at? There’s just a lot of complexity there that I feel like is the first step to unpick so that I as a brand or retailer could then go, I understand the reference frame and I understand the structure that I need to approach my catalog through so that I can get it ready for what’s next.

How do you think about that? What should people be doing to understand the composition of AI traffic so that they can start to optimise for it?

Yeah, I think that’s right. So my company, New Generation, we’re building a product called Kepler, which is an AI storefront. And as a part of the AI storefront, it gives you out of the box the ability to identify and see not only which visitors are coming to your site, human or agent, but what you said. What questions are they asking? How are they trying to search your catalog and navigate with this new thing, natural language? And we think that’s a great place to start because it gives you a clear understanding of what your reality is today that you currently can’t see. And it’s your first party data. You’re gonna take that information and that’s gonna be helpful for you maybe across your whole business. So I would say it’s actually a lot easier to get started than I think a lot of people think.

Back to this whole AI overwhelm. It’s really not that challenging. In fact, it takes us about a week to set this up for a brand. That’s the first thing I would say. And really quick, the second thing is, even without doing any of that work to instrument that kind of logging and analytics, you can assess your website’s current readiness to receive AI traffic. That’s probably the easiest thing to do, which is if you assume that this is a technology that’s not gonna go away, and you assume that serving agents and participating in this LLM ecosystem is of paramount importance, which I would say 100 % it is, we have a thing called agent score, which is really cool, it will batter your website with about 100 different agents and many, different queries. And it will give you a report and it will tell you: here’s how prepared your website is to answer agent questions. These are the categories where it answered well. These are the ones where it answered poorly. This is how long it took. It’s very interesting.

Well, I think webmasters who are dedicating a lot of time to page speed and other kinds of metrics should probably devote some attention to that from the sound of it.

A very final question to you, Jonathan, would be, The Interline is going to be releasing our third deep dive downloadable report on AI this spring. What topic or topics do you think are not being covered in the right way or in sufficient detail?

This is the one moment I’m going to tell you to cut the space, the pause here. That’s a good question.

I would say there’s been a lot of ink spilt on AEO, GEO, and a lot of noise around the big model providers. I would say the thing that’s not being covered enough is how easy it is to take AI technology and add that layer to your website. For example, what does that mean? Tactically, practically? How do you get started? This is the assumption that websites are gonna transition from being static, unintelligent interfaces and unintelligent product catalogs to a tech stack that is AI native.

We have to do a lot of education around how we think about that, how we’re building our products and what the benefits are. I think it’s overlooked. First party data. First party intelligence we think is absolutely critical. It’s also super easy because it’s a simple tool you can just add to your existing tech stack without having to rewrite anything or invest in a multi-year long shift.

Cool. Okay. That’s going on our remit for the next report on that basis.

Jonathan, it’s been a real pleasure talking to you. Thank you for the time that you’ve given me today. This has been a really enlightening conversation. You’ve prompted me to think about some things in some different ways, which happens sparingly, but does happen on the course of this podcast. So I really value all of your perspectives here and I hope we have a chance to chat again in the future.

Same here, those were amazing questions. So props to you and I really appreciate the conversation.

And that’s the end of my chat with Jonathan. I always enjoy talking to tech executives like him because being able to interrogate why people create technology solutions is a good route to understanding “where the puck is headed”, to borrow that old Wayne Gretzky quote. And when it comes to the impact that AI could have on online retail, on search and product discovery, and on the web in general.

It does feel like that puck could go a really long way this year. We’re to be keeping a close eye on this and plenty of other AI stories, both front and back end in our 2026 AI Report in the springtime. And we have plenty of other guests joining me, some to talk about AI, some of those very much not, very soon.

For now, thanks for listening and I’ll talk to you again soon.