Released in The Interline’s DPC Report 2026, this executive interview is one of an eight-part series that sees The Interline quiz executives from major DPC companies on the evolution of 3D and digital product creation tools and workflows, and ask their opinions on what the future holds for the the extended possibilities of digital assets.

For more on digital product creation in fashion, download the full DPC Report 2026 completely free of charge and ungated.

For a while now the broad shape and scope of 3D and DPC strategies have been generally accepted, but now companies are asking some fundamental questions about how far those initiatives should stretch. Some see a clear opportunity to take them further. Others potentially see arguments for either ringfencing them where they stand, or possibly even scaling them back. Technology footprints will always morph over time, but this feels like a deviation from the standard. What’s your perspective?

I don’t view this as a deviation, but rather as a necessary phase of optimization and maturity for the industry. We are transitioning from a phase of ‘blind adoption’—where companies rushed in due to hype—to a phase of ‘strategic calibration.’

The divergence you see is actually a sign that the market is evolving:

The companies scaling back are likely realizing that implementing 3D as a standalone tool isn’t enough. They are pausing to realign their strategies because they haven’t yet connected the technology to their core business data.

On the other hand, the companies pushing further have successfully moved past the experimentation phase. They are integrating 3D as the backbone of their entire value chain, linking it to manufacturing, costing, and consumer engagement.

So, this is not a stagnation of the technology itself. It is the industry refining its roadmap, moving towards a more practical and high-impact application of DPC. It’s a classic example of a market maturing to find the most efficient path forward.

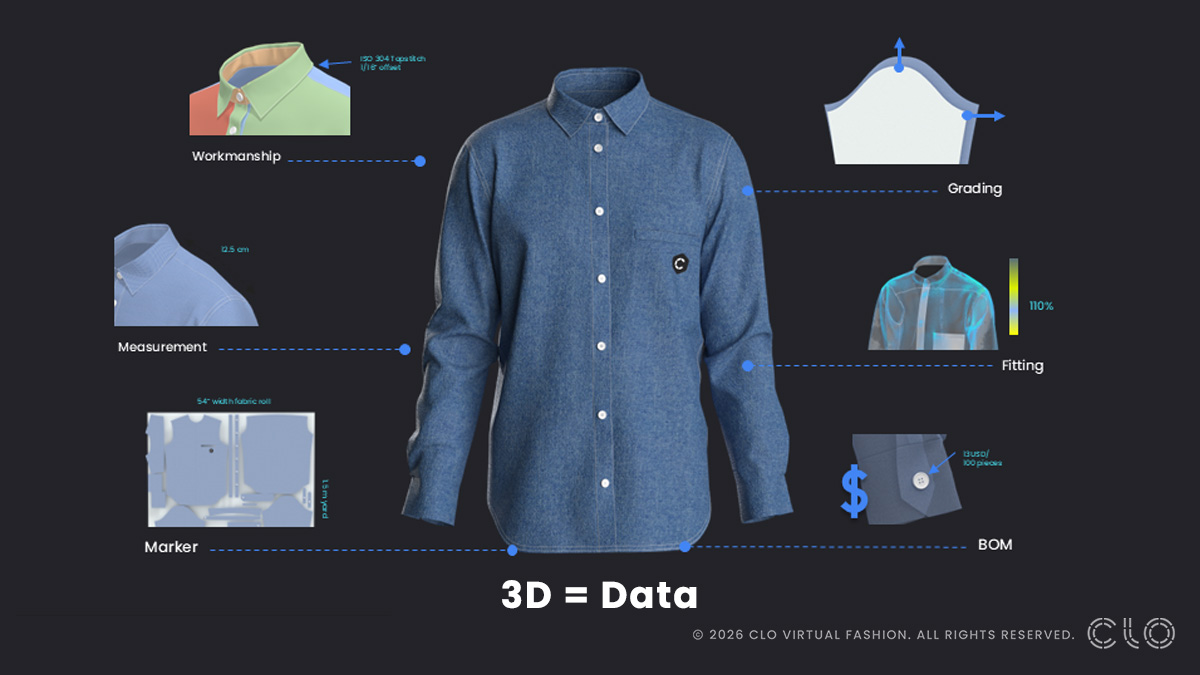

Yes, and I see this as the most natural progression because the 3D asset is the only entity that inherently fuses ‘Visuals’ with ‘Data’.

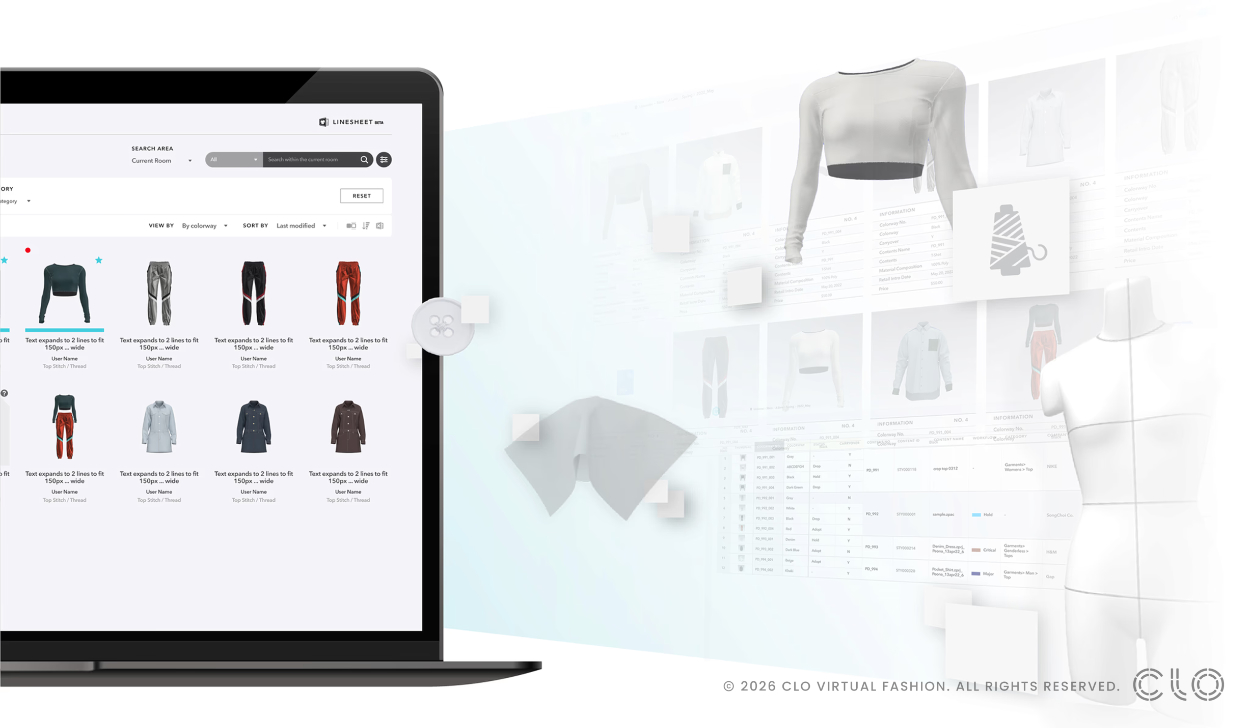

Unlike abstract rows in an Excel sheet or traditional text-based platforms, a 3D asset provides immediate visual context alongside technical specifications. This makes it the most efficient, intuitive medium for communication across the entire lifecycle, significantly reducing the manual interpretation and data entry that legacy tools require.

Because 3D is so much easier to use and understand, when it is adopted across the workflow, it naturally evolves into a ‘Dynamic Data Container.’ As the asset travels from design to sourcing and production, it organically aggregates layers of critical information—production details, communication history, ESG metrics, and costing data. It doesn’t just store the ‘look’ of the product; it captures its entire history.

To accelerate this reality, our core mission is to enforce Standardization and Interoperability. We are focused on building the infrastructure that allows this rich, data-heavy 3D asset to flow frictionlessly through every stage, cementing its role as the true single source of truth.

Right now, brands and their vendor partners exchange 3D assets – full products, or meshes, materials, components etc. – with the objective of aligning everyone as quickly and effectively as possible on key product outcomes like fit, performance, and quality. If we think of a near-term future where those 3D assets also embody a much wider set of datapoints that can serve different objectives, such as supply chain transparency, how do you see that exchange affecting the dynamics and the relationships between brands and their partners, if the 3D objects they’re collaborating on become more valuable than before?

This shift signifies the end of the ‘Black Box’ era and the beginning of a ‘Glass Box’ partnership; 3D assets evolving to carry transparent data regarding supply chains.

I see it as a transformation into a higher-value relationship. The dynamic shifts from being transactional (simply buying a product) to being collaborative and technical.

In this transparent environment, a vendor’s value is no longer defined by ‘who they know’ (sourcing secrets), but by ‘how well they execute’ using the shared 3D data. Vendors become technical engineering partners who use the 3D asset to simulate production, optimize costs, and solve problems before physical manufacturing begins.

Because the 3D object itself becomes so valuable—containing the intellectual property of the brand and the technical know-how of the vendor—the ‘exchange’ mechanism becomes critical. We need secure platforms that allow for granular permission control. Brands need to share the design without exposing sensitive margins, and vendors need to input production data without losing their IP.

Ultimately, the relationship evolves from a negotiation based on hidden information to a collaboration based on a shared, transparent reality (the 3D asset).

By the same token, this “data-fication” of 3D also places greater emphasis on vendors’ ability to work in 3D – and elevates those suppliers that have already built-out digital product creation capabilities even further. How do you see this transition playing out in a sourcing landscape that’s, right now, primarily driven by price competitiveness and capacity rather than digital capabilities?

In the DPC era, the definition of price competitiveness is being completely redefined.

Vendors with digital capabilities aren’t just offering ‘tech’; they are offering efficiency that translates directly into cost savings. By using 3D, they eliminate physical sampling rounds, reduce material waste, and drastically shorten lead times. This means the ‘Total Cost’ for the buyer goes down, even if the manufacturing unit price remains the same.

Those who adopt 3D will evolve from simple manufacturers into ‘Solution Providers.’ They will say to brands, ‘Send us your 3D file, and we will optimize the pattern for yield and simulate production to give you the best price and speed.

In this new landscape, digital capability IS the new price competitiveness. Brands will inevitably flock to vendors who speak the language of data, because that is where the true efficiency—and profitability—now lies.

The other key beneficiary of 3D becoming more of a data foundation is the buyer, whether that’s an end consumer or a retail partner. Other consumer-facing, product-centric industries have put 3D representations in front of their buyers, but fashion garments a unique proposition in their variety, their velocity to market, and the subjective elements of fit, touch, feel and self-identity. Beyond digital product passports, where there’s a clear through-line from 3D as a data layer to disclosure and communication, how do you see 3D developing as a multi-faceted touchpoint for consumers that communicates more than just aesthetics?

I see 3D evolving from a static visualization into a medium of ‘Experience’ and ‘Trust.’ Because fashion is so personal and tactile, 3D must bridge the gap between the digital screen and physical sensation.

First, 3D communicates ‘Physical Confidence.’ Unlike a 2D photo, a physics-based 3D asset communicates weight, drape, and fit. It moves beyond aesthetics to answer the consumer’s most critical question: ‘How will this behave on me?’ By providing accurate virtual try-ons and physics simulations, 3D serves as a functional touchpoint that drastically reduces the ‘imagination gap’ and, consequently, returns.

Second, 3D becomes a vessel for ‘Verified Transparency.’ Consumers today want to know the story behind the product. Instead of reading a boring label, 3D allows them to interact with the garment’s digital twin—clicking on a fabric to see its carbon footprint or origin. Here, 3D transforms dry data into an engaging narrative, building deeper brand trust.

Finally, it serves as a platform for ‘Co-creation and Identity.’ Fashion is about self-expression. 3D empowers consumers to become creators—customizing colors, mixing and matching components, or even owning the digital asset in virtual spaces.

In essence, 3D shifts the consumer role from a passive viewer of a product image to an active participant in the product’s journey and experience.

What’s the most useful question that companies can ask themselves, right now, to better understand what they want to accomplish next with 3D – whether that’s driven by their own ambitions, or by changes in the market?

The most critical question companies must ask themselves is:

‘If we were to strip away the visual rendering from our 3D file, would it still hold value?’

This question cuts to the core of the strategy. If the answer is ‘No’, then you are using 3D merely for visualization—essentially replacing a photograph with a digital image. While this offers some aesthetic benefits, it limits the technology’s potential to a single silo.

If the answer is ‘Yes’—meaning that underneath the visual layer, there remains a rich foundation of data: patterns, BOMs, costing, and ESG metrics—then you are building a true ‘Digital Asset.’

Companies need to decide right now: Are we building a gallery of digital images, or are we constructing a database of digital twins that can power our supply chain, ensure compliance, and automate our business? The future belongs to those who answer ‘Yes’ to the value of the data, not just the pixel.